Research Topics

Publications on United States

-

Black Employment Trends since the Great Recession

Working Paper No. 915 | September 2018The Great Recession had a devastating impact on labor force participation and employment. This impact was not unlike other recessions, except in size. The recovery, however, has been unusual not so much for its sluggishness but for the unusual pattern of recovery in employment by race. The black employment–population ratio has increased since bottoming out in 2010, while the white employment–population ratio has remained flat. This paper examines trends in labor force participation and employment by race, sex, and age and determines that the explanation is a combination of an aging white population and an increase in labor force participation among younger black people. It estimates the likelihood of labor force participation and employment among young men and women to control for confounding factors (such as changes in educational characteristics) and decomposes the gaps among groups and the changes over time in labor force participation using a Oaxaca-Blinder-like technique for nonlinear estimations. Findings indicate that much smaller negative impacts of characteristics and greater returns to characteristics among young black men and women than among young white men and women explain the observed trends.Download:Associated Program:Author(s): -

Quality of Match for Statistical Matches Using the American Time Use Survey 2013, the Survey of Consumer Finances 2013, and the Annual Social and Economic Supplement 2014

Working Paper No. 914 | September 2018This paper describes the quality of the statistical matching between the March 2014 supplement to the Current Population Survey (CPS) and the 2013 American Time Use Survey (ATUS) and Survey of Consumer Finances (SCF), which are used as the basis for the 2013 Levy Institute Measure of Economic Well-Being (LIMEW) estimates for the United States. In the first part of the paper, the alignment of the datasets is examined. In the second, various aspects of the match quality are described. The results indicate that the matches are of high quality, with some indication of bias in specific cases.Download:Associated Program:Author(s): -

Why the United States Will Beat China to the Next Minsky Moment

One-Pager No. 54 | February 2018The outgoing governor of the People’s Bank of China recently warned of a possible Chinese “Minsky moment”—Paul McCulley’s term, most recently applied to the 2007 US real estate crash that reverberated around the world as a global financial crisis. Although Western commentators have weighed in on both sides of the debate about the likelihood of China’s debt bubble bursting, Senior Scholar L. Randall Wray argues that too little attention is being paid to the far more probable repeat of a US Minsky moment. US prospects for growth, as well as for successfully handling the next financial meltdown, are dismal, he concludes.

Download:Associated Program:Author(s): -

The Concert of Interests in the Age of Trump

Policy Note 2017/2 | July 2017If the Trump administration is to fulfill its campaign promises to this age’s “forgotten” men and women, Director of Research Jan Kregel argues, it should embrace the broader lesson of the 1930s: that government regulation and fiscal policy are crucial in addressing changes in the economic and financial structure that have exacerbated the problems faced by struggling communities.

In this policy note, Kregel explains how overcoming the economic and financial challenges we face today, just as in the 1930s, requires avoiding what Walter Lippmann identified as an “obvious error”: the blind belief that reducing regulation and the role of government will somehow restore a laissez-faire market liberalism that never existed and is inappropriate to the changing structure of production of both the US and the global economy.

Download:Associated Program:Author(s):Jan Kregel -

Gender, Socioeconomic Status, and Time Use of Married and Cohabiting Parents during the Great Recession

Working Paper No. 888 | April 2017Using data from the 2003–14 American Time Use Survey (ATUS), this paper examines the relationship between the state unemployment rate and the time that opposite-sex couples with children spend on childcare activities, and how this varies by the socioeconomic status (SES), race, and ethnicity of the mothers and fathers. The time that mothers and fathers spend providing primary and secondary child caregiving, solo time with children, and any time spent as a family are considered. To explore the impact of macroeconomic conditions on the amount of time parents spend with children, the time-use data are combined with the state unemployment rate data from the US Bureau of Labor Statistics. The analysis finds that the time parents spend on child-caregiving activities or with their children varies with the unemployment rate in low-SES households, African-American households, and Hispanic households. Given that job losses were disproportionately high for workers with no college degree, African-Americans, and Hispanics during the Great Recession, the results suggest that the burden of household adjustment during the crisis fell disproportionately on the households most affected by the recession.

-

The Trump Effect: Is This Time Different?

Strategic Analysis, April 2017 | April 2017From a macroeconomic point of view, 2016 was an ordinary year in the post–Great Recession period. As in prior years, the conventional forecasts predicted that this would be the year the economy would finally escape from the “new normal” of secular stagnation. But just as in every previous year, the forecasts were confounded by the actual result: lower-than-expected growth—just 1.6 percent.

The radical policy changes promoted by the new Trump administration dominated economic conditions in the closing quarter of the year and the first quarter of 2017. Markets have responded with exuberance since the November elections, on the expectation that the proposed policy measures would increase profitability by boosting growth and cutting personal and corporate taxes. However, an evaluation of the US economy’s structural characteristics reveals three key impediments to a robust, sustainable recovery: income inequality, fiscal conservatism, and weak net export demand. The new administration’s often conflicting policy proposals are unlikely to solve any of these fundamental problems—if anything, the situation will worsen.

Our latest Strategic Analysis provides two medium-term scenarios for the US economy. The “business as usual” baseline scenario (built on CBO estimates) shows household debt and GDP growth roughly maintaining their moribund postcrisis trends. The second scenario assumes a sharp correction in the stock market beginning in 2017Q3, combined with another round of private sector deleveraging. The results: negative growth and a government deficit of 8.3 percent by 2020—essentially a repeat of the crisis of 2007–9.Download:Associated Program:Author(s): -

Inequality Update: Who Gains When Income Grows?

Policy Note 2017/1 | April 2017Since the 1980s, economic recoveries in the United States have been delivering the vast majority of income growth to the wealthiest households. This policy note updates the analysis in One-Pager No. 47 and Policy Note 2015/4 with the latest data through 2015, looking at the distribution of average income growth (with and without capital gains) between the bottom 90 percent and top 10 percent of households, and between the bottom 99 percent and top 1 percent of households.

Little has changed when considering the distribution of average income growth in the current recovery (up to 2015) between the bottom 90 percent and top 10 percent of families, with or without capital gains. Although average real income for the bottom 90 percent of households is no longer shrinking, these families still capture a historically small proportion of that growth—only between 18 percent and 22 percent. The growing economy continues to deliver the most benefits to the wealthiest families.Download:Associated Program:Author(s): -

The Great Recession and Racial Inequality

Working Paper No. 880 | January 2017Evidence from Measures of Economic Well-Being

The Great Recession had a tremendous impact on low-income Americans, in particular black and Latino Americans. The losses in terms of employment and earnings are matched only by the losses in terms of real wealth. In many ways, however, these losses are merely a continuation of trends that have been unfolding for more than two decades. We examine the changes in overall economic well-being and inequality as well as changes in racial economic inequality over the Great Recession, using the period from 1989 to 2007 for historical context. We find that while racial inequality increased from 1989 to 2010, during the Great Recession racial inequality in terms of the Levy Institute Measure of Economic Well-Being (LIMEW) decreased. We find that changes in base income, taxes, and income from nonhome wealth during the Great Recession produced declines in overall inequality, while only taxes reduced between-group racial inequality.

Download:Associated Programs:The Distribution of Income and Wealth Gender Equality and the Economy The State of the US and World EconomiesAuthor(s): -

What We Could Have Learned from the New Deal in Confronting the Recent Global Recession

Public Policy Brief No. 141, 2016 | March 2016To the extent that policymakers have learned anything at all from the Great Depression and the policy responses of the 1930s, the lessons appear to have been the wrong ones. In this public policy brief, Director of Research Jan Kregel explains why there is still a great deal we have to learn from the New Deal. He illuminates one of the New Deal’s principal objectives—quelling the fear and uncertainty of mass unemployment—and the pragmatic, experimental process through which the tool for achieving this objective—directed government expenditure—came to be embraced.

In the search for a blueprint from the 1930s, Kregel suggests that too much attention has been paid to the measures deployed to shore up the banking system, and that the approaches underlying the emergency financial policy measures of the recent period and those of the 1930s were actually quite similar. The more meaningful divergence between the 1930s and the post-2008 policy response, he argues, can be uncovered by comparing the actions that were taken (or not taken, as the case may be) to address the real sector of the economy following the resolution of the respective financial crises.Download:Associated Program:Author(s):Jan Kregel -

Destabilizing an Unstable Economy

Strategic Analysis, March 2016 | March 2016Our latest strategic analysis reveals that the US economy remains fragile because of three persistent structural issues: weak demand for US exports, fiscal conservatism, and a four-decade trend in rising income inequality. It also faces risks from stagnation in the economies of the United States’ trading partners, appreciation of the dollar, and a contraction in asset prices. The authors provide a baseline and three alternative medium-term scenarios using the Levy Institute’s stock-flow consistent macro model: a dollar appreciation and reduced growth in US trading partners scenario; a stock market correction scenario; and a third scenario combining scenarios 1 and 2. The baseline scenario shows that future growth will depend on an increase in private sector indebtedness, while the remaining scenarios underscore the linkages between a fragile US recovery and instability in the global economy.Download:Associated Program:Author(s): -

Losing Ground

Policy Note 2015/7 | November 2015Demographic Trends in US Labor Force Participation

US labor force participation has continued to fall in the wake of the Great Recession. Improvements in the US unemployment rate reflect the fact that more people are falling out of the labor force, not a stronger labor market. Controlling for changes in the demographic makeup of the workforce (i.e., gender, age, education, and race), Research Scholar Fernando Rios-Avila investigates trends in labor force participation across and within groups between 1989 and 2013. He finds that not all groups have lost ground equally, while participation rates for some groups have actually increased. Understanding these patterns in labor force participation is a necessary first step toward crafting effective policy responses.

Download:Associated Program:Author(s): -

Fiscal Austerity, Dollar Appreciation, and Maldistribution Will Derail the US Economy

Strategic Analysis, May 2015 | May 2015In this latest Strategic Analysis, the Institute’s Macro Modeling Team examines the current, anemic recovery of the US economy. The authors identify three structural obstacles—the weak performance of net exports, a prevailing fiscal conservatism, and high income inequality—that, in combination with continued household sector deleveraging, explain the recovery’s slow pace. Their baseline macro scenario shows that the Congressional Budget Office’s latest GDP growth projections require a rise in private sector spending in excess of income—the same unsustainable path that preceded both the 2001 recession and the Great Recession of 2007–9. To better understand the risks to the US economy, the authors also examine three alternative scenarios for the period 2015–18: a 1 percent reduction in the real GDP growth rate of US trading partners, a 25 percent appreciation of the dollar over the next four years, and the combined impact of both changes. All three scenarios show that further dollar appreciation and/or a growth slowdown in the trading partner economies will lead to an increase in the foreign deficit and a decrease in the projected growth rate, while heightening the need for private (and government) borrowing and adding to the economy’s fragility.Download:Associated Program:Author(s): -

A Decade of Declining Wages

Policy Note 2015/3 | March 2015From Bad to Worse

In a recent policy note (A Decade of Flat Wages?) we examined wage trends since 1994, and found that while wages grew between 1994 and 2002, average real wages stagnated or declined after 2002–03. Our latest study provides a more detailed analysis of wage trends for wage-level, age, and education groups, with emphasis on the periods following the 2001 and 2007–09 recessions. There was a more or less cohesive evolution of wages among different groups until 2002–03. However, after controlling for structural changes in the labor force, wages diverged sharply in the years that followed for different age, education, and wage groups, with the majority of workers experiencing real declines in their wages. This was not a short-term decline among a few numerically insignificant groups. Nearly two-thirds of all full-time wage earners have less than a four-year college degree and saw their wages decline compared to peak wages in 2002. Workers aged 44 and younger, representing slightly more than 38 million full-time wage earners or 71.4 percent of all full-time wage earners in the United States, also experienced a large reduction in cumulative wage growth after 2002. In terms of wage groups, the bottom 75 percent of full-time workers saw a decline in real wages, while those at the top of the wage distribution saw their wages rise—clear evidence of increasing wage inequality. Given the downward trend in real wages for the majority of full-time wage earners since 2009, it should come as no surprise that recovery from the Great Recession has been weak. In the absence of an employer-of-last-resort policy, federal and state policy must focus its efforts on increasing wages through measures such as progressive tax policy, raising the minimum wage, ensuring overtime pay laws are enforced, and creating opportunities for the most vulnerable workers.Download:Associated Program:Author(s): -

Quality of Match for Statistical Matches Using the Consumer Expenditure Survey 2011 and Annual Social Economic Supplement 2011

Working Paper No. 830 | January 2015This paper describes the quality of the statistical match between the Current Population Survey (CPS) March 2011 supplement and the Consumer Expenditure Survey (CEX) 2011, which are used for the integrated inequality assessment model for the United States. In the first part of this paper, the alignment of the datasets is examined. In the second, various aspects of the match quality are described. The results show appropriate balance across different characteristics, with some imbalances within narrow characteristics.

Download:Associated Program:Author(s): -

Economic Development and Financial Instability: Selected Essays

Book Series, October 2014 | October 2014By Jan A. Kregel. Edited by Rainer Kattel. Foreword by G. C. Harcourt.

This volume is the first collection of essays by Jan Kregel focusing on the role of finance in development and growth, and it demonstrates the extraordinary depth and breadth of this economist’s work. Considered the “best all-round general economist alive” (Harcourt), Kregel is a senior scholar and director of the monetary policy and financial structure program at the Levy Economics Institute, and professor of development finance at Tallinn University of Technology. These essays reflect his deep understanding of the nature of money and finance and of the institutions associated with them, and of the indissoluble relationship between these institutions and the real economy—whether in developed or developing economies. Kregel has expanded Hyman Minsky’s original premise that in capitalist economies stability engenders instability, and Kregel’s key works on financial instability, its causes and effects, as well as his discussions of the global financial crisis and Great Recession, are included here.

Published by: Anthem Press

This volume is the first collection of essays by Jan Kregel focusing on the role of finance in development and growth, and it demonstrates the extraordinary depth and breadth of this economist’s work. Considered the “best all-round general economist alive” (Harcourt), Kregel is a senior scholar and director of the monetary policy and financial structure program at the Levy Economics Institute, and professor of development finance at Tallinn University of Technology. These essays reflect his deep understanding of the nature of money and finance and of the institutions associated with them, and of the indissoluble relationship between these institutions and the real economy—whether in developed or developing economies. Kregel has expanded Hyman Minsky’s original premise that in capitalist economies stability engenders instability, and Kregel’s key works on financial instability, its causes and effects, as well as his discussions of the global financial crisis and Great Recession, are included here.

Published by: Anthem Press

-

A Decade of Flat Wages?

Policy Note 2014/4 | June 2014In the late 1990s low unemployment rates, increases in the minimum wage, and improvements in labor productivity contributed to a boost in wages, which translated into 12.4 percent cumulative growth in real wages from the late ‘90s until 2002. Real wages then stagnated despite continued growth in labor productivity. This period between 2002 and 2013 has become known as the decade of flat wages. However, over the same period there were significant changes in the composition of the labor market. In particular, the labor force has aged and become more educated. Increases in age, experience, and education could in fact be propping up observed real wages—meaning that wages of workers with a specific age and education profile may have actually declined over the decade. This is exactly what we uncover in this policy note: what appears to have been a decade of flat real wages was actually a decade of declining real wages within age/education worker profiles. -

Quality of Match for Statistical Matches Using the American Time Use Survey 2010, the Survey of Consumer Finances 2010, and the Annual Social and Economic Supplement 2011

Working Paper No. 798 | May 2014This paper describes the quality of the statistical matching between the March 2011 supplement to the Current Population Survey and the 2010 American Time Use Survey and Survey of Consumer Finances, which are used as the basis for the 2010 LIMEW estimates for the United States. In the first part of the paper, the alignment of the datasets is examined. In the second, various aspects of the match quality are described. The results indicate that the matches are of high quality, with some indication of bias in specific cases.

Download:Associated Programs:Author(s): -

Is Rising Inequality a Hindrance to the US Economic Recovery?

Strategic Analysis, April 2014 | April 2014The US economy has been expanding moderately since the official end of the Great Recession in 2009. The budget deficit has been steadily decreasing, inflation has remained in check, and the unemployment rate has fallen to 6.7 percent. The restrictive fiscal policy stance of the past three years has exerted a negative influence on aggregate demand and growth, which has been offset by rising domestic private demand; net exports have had only a negligible (positive) effect on growth. As Wynne Godley noted in 1999, in the Strategic Analysis Seven Unsustainable Processes, if an economy faces sluggish net export demand and fiscal policy is restrictive, economic growth becomes dependent on the private sector’s continuing to spend in excess of its income. However, this continuous excess is not sustainable in the medium and long run. Therefore, if spending were to stop rising relative to income, without either fiscal relaxation or a sharp recovery in net exports, the impetus driving the expansion would evaporate and output could not grow fast enough to stop unemployment from rising. Moreover, because growth is so dependent on “rising private borrowing,” the real economy “is at the mercy of the stock market to an unusual extent.” As proved by the crisis of 2001 and the Great Recession of 2007–09, Godley’s analysis turned out to be correct. Fifteen years later, the US economy appears to be going down the same road again. Postrecession, foreign demand is still weak and the government is maintaining its tight fiscal stance. Once again, the recovery predicted in the latest Congressional Budget Office report relies on excessive private sector borrowing, and once again, the recovery is at the mercy of the stock market. Given that the income distribution has worsened since the crisis—continuing a 35-year trend—the burden of indebtedness will again fall disproportionally on the middle class and the poor. In order for the CBO projections to materialize, households in the bottom 90 percent of the distribution would have to start accumulating debt again in line with the prerecession trend while the stock of debt of the top 10 percent remained at its present level. Clearly, this process is unsustainable. The United States now faces a choice between two undesirable outcomes: a prolonged period of low growth—secular stagnation—or a bubble-fueled expansion that will end with a serious financial and economic crisis. The only way out of this dilemma is a reversal of the trend toward greater income inequality.Download:Author(s): -

Financial Governance after the Crisis

Conference Proceedings, September 26–27, 2013 | April 2014Cosponsored by the Levy Economics Institute of Bard College and MINDS – Multidisciplinary Institute for Development and Strategies, with support from the Ford Foundation

Everest Rio Hotel

Rio de Janeiro, Brazil

September 26–27, 2013

This conference was organized as part of the Levy Institute’s global research agenda and in conjunction with the Ford Foundation Project on Financial Instability, which draws on Hyman Minsky's extensive work on the structure of financial governance and the role of the state. Among the key topics addressed: designing a financial structure to promote investment in emerging markets; the challenges to global growth posed by continuing austerity measures; the impact of the credit crunch on economic and financial markets; and the larger effects of tight fiscal policy as it relates to the United States, the eurozone, and the BRIC countries.Download:Associated Program: -

Is the Link between Output and Jobs Broken?

Strategic Analysis, March 2013 | March 2013

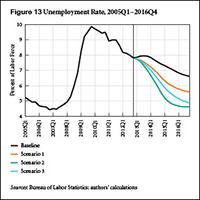

As this report goes to press, the official unemployment rate remains tragically elevated, compared even to rates at similar points in previous recoveries. The US economy seems once again to be in a “jobless recovery,” though the unemployment rate has been steadily declining for years. At the same time, fiscal austerity has arrived, with the implementation of the sequester cuts, following tax increases and the ending of emergency extended unemployment benefits just two months ago.

Our new report provides medium-term projections of employment and economic growth under four different scenarios. The baseline scenario starts by assuming the same growth rates and government deficits as the Congressional Budget Office’s (CBO) baseline projection from earlier this year. The result is a new surge of the unemployment rate to nearly 8 percent in the third quarter of this year, followed by a very gradual new recovery. Scenarios 1 and 2 seek to reach unemployment-rate goals of 6.5 percent and 5.5 percent, respectively, by the end of next year, using new fiscal stimulus.

We find in these simulations that reaching the goals requires large amounts of fiscal stimulus, compared to the CBO baseline. For example, in order to reach 5.5 percent unemployment in 2014, scenario 2 assumes 11 percent growth in inflation-adjusted government spending and transfers, along with lower taxes.

As an alternative, scenario 3 adds an extra increase to growth abroad and to private borrowing, along with the same amount of fiscal stimulus as in scenario 1. In this last scenario of the report, the unemployment rate finally pierces the 5.5 percent threshold from the previous scenario in the third quarter of 2015. We conclude with some thoughts about how such an increase in demand from all three sectors—government, private, and external—might be realistically obtained.

Download:Associated Program:Author(s): -

Beyond Pump Priming

One-Pager No. 16 | October 2011The American Jobs Act now before Congress relies largely on a policy of aggregate demand management, or “pump priming”: injecting demand into a frail economy in hopes of boosting growth and lowering unemployment. But this strategy, while beneficial in setting a floor beneath economic collapse, fails to produce and maintain full employment, while doing little to address income inequality. The alternative? Fiscal policy that directly targets unemployment by providing paid work to all those willing to do their part.

Download:Associated Programs:Author(s): -

Minsky’s View of Capitalism and Banking in America

One-Pager No. 6 | November 2010Before we can reform the financial system, we need to understand what banks do—or, better yet, what banks should do. Senior Scholar L. Randall Wray examines Hyman Minsky’s views on banking and the proper role of the financial system—not simply to finance investment in physical capital but to promote the “capital development” of the economy as a whole and the improvement of living standards, broadly defined.

Download:Associated Program:Author(s): -

Preventing Another Crisis

One-Pager No. 5 | November 2010The Need for More Profound Reforms

There is no justification for the belief that cutting spending or raising taxes by any amount will reduce the federal deficit, let alone permit solid growth. The worst fears about recent stimulative policies and rapid money-supply growth are proving to be incorrect once again. We must find the will to reinvigorate government and to maintain Keynesian macro stimulus in the face of ideological opposition and widespread mistrust of government.

Download:Associated Program:Author(s): -

Measuring Poverty Using Both Income and Wealth

Working Paper No. 620 | September 2010An Empirical Comparison of Multidimensional Approaches Using Data for the US and Spain

This paper presents a comparative analysis of the approaches to poverty based on income and wealth that have been proposed in the literature. Two types of approaches are considered: those that look at income and wealth separately when defining the poverty frontier, and those in which these two dimensions are integrated into a single index of welfare. We illustrate the implications of these approaches on the structure of poverty using data for two industrialized countries—for example, the United States and Spain. We find that the incidence of poverty in these two countries varies significantly depending on the poverty definition adopted. Despite this variation, our results suggest that the poverty problem is robust to changes in the way poverty is measured. Regarding the identification of the poor, there is a high level of misclassification between the poverty indices: for most of the pairwise comparisons, the proportion of households that are misclassified is above 50 percent. Interestingly, the rate of misclassification in the United States is significantly lower than in Spain. We argue that the higher correlation between income and wealth in the United States contributes to explaining the greater overlap between poverty indices in this country.

Download:Associated Program:Author(s):Francisco Azpitarte -

Quality of Match for Statistical Matches Used in the 1992 and 2007 LIMEW Estimates for the United States

Working Paper No. 618 | September 2010The quality of match of four statistical matches used in the LIMEW estimates for the United States for 1992 and 2007 is described. The first match combines the 1992 Survey of Consumer Finances (SCF) with the 1993 March Supplement to the Current Population Survey, or Annual Demographic Supplement (ADS). The second match combines the 1985 American Use of Time Project survey (AUTP) with the 1993 ADS. The third match combines the 2007 SCF with the 2008 March Supplement to the CPS, now called the Annual Social and Economics Supplement (ASEC). The fourth match combines the 2007 American Time Use Survey with the 2008 ASEC. In each case, the alignment of the two datasets is examined, after which various aspects of the match quality are described. Also in each case, the matches are of high quality, given the nature of the source datasets.

Download:Associated Programs:Author(s): -

Three Futures for Postcrisis Banking in the Americas

Working Paper No. 604 | June 2010The Financial Trilemma and the Wall Street Complex

This would seem an opportune moment to reshape banking systems in the Americas. But any effort to rethink and improve banking must acknowledge three major barriers. The first is a crisis of vision: there has been too little consideration of what kind of banking system would work best for national economies in the Americas. The other two constraints are structural. Banking systems in Mexico and the rest of Latin America face a financial regulation trilemma, the logic and implications of which are similar to those of smaller nations’ macroeconomic policy trilemma. The ability of these nations to impose rules that would pull banking systems in the direction of being more socially productive and economically functional is constrained both by regional economic compacts (in the case of Mexico, NAFTA) and by having a large share of the domestic banking market operated by multinational banks.

For the United States, the structural problem involves the huge divide between Wall Street megabanks and the remainder of the US banking system. The ambitions, modes of operation, and economic effects of these two different elements of US banking are quite different. The success, if not survival, of one element depends on the creation of a regulatory atmosphere and set of enabling federal government subsidies or supports that is inconsistent with the success, or survival, of the other element.

Download:Associated Program:Author(s):Gary A. Dymski -

A Balancing Act

One-Pager No. 1 | May 2010How to End America's Trade Deficits

Now that America’s financial institutions have been brought back from the brink, the greatest threat to global economic stability is the gigantic trade imbalance between the United States, China, and other trading partners. A second big threat to economic stability, in the longer run, is global warming. Both problems are related to America’s addiction to cheap imports and foreign oil—bad habits that a clever cap-and-trade system could help us kick at last.

Download:Associated Program:Author(s): -

A Financial Sector Balance Approach and the Cyclical Dynamics of the US Economy

Working Paper No. 576 | September 2009This paper investigates the relationship between asset markets and business cycles with regard to the US economy. We consider the Goldman Sachs approach (2003) developed to study the dynamics of financial balances.

By means of a small econometric model we find that asset market dynamics are fundamental to determining the long-run financial sector balance dynamics. The gap between long-run equilibrium values and the actual values of the financial balances help to explain the cyclical path of the economy. Among all financial sectors balances, the financing gap in the corporate sector shows a leading effect on business cycles, in a Minskyan spirit. The last results appear innovative with respect to Goldman Sachs’s findings. Furthermore, our econometric results are robust and quite stable.

Download:Associated Program:Author(s):Paolo Casadio Antonio Paradiso -

Statement of Professor James K. Galbraith to the Subcommittee on Domestic Monetary Policy and Technology, Committee on Financial Services, US House of Representatives

Testimony, July 9, 2009 | July 2009On July 9, 2009, Senior Scholar James K. Galbraith testified before the House Financial Services Committee regarding the functions of the Federal Reserve under the Obama administration’s proposals for financial regulation reform—specifically, the extent to which the newly proposed role of systemic risk regulator might conflict with the Fed’s traditional role as the independent authority on monetary policy. He also addressed questions of whether the Fed should relinquish its role in consumer protection, and whether the shadow banking system should be restored.

Galbraith pointed out that the Board’s primary mission is macroeconomic: “Rigorous enforcement of safety and soundness regulation is never going to be the first priority of the agency in the run-up to a financial crisis.” Systemic risk regulation needs to be deeply integrated into ongoing examination and supervision—a function best taken on by an agency “with no record of regulatory capture or institutional identification with the interests of the regulated sector.” That agency, said Galbraith, is the FDIC. If systemic risk is to be subject to consolidated prudential regulation, why not place that responsibility in the hands of an agency for which it is the first priority? Further, if large banks and other financial holding companies pose systemic risks, why not require them to divest and otherwise reduce the concentration of power that presently exists in the financial sector? In Galbraith’s view it would, over time, “bring the scale of financial activity into line with the capacity of supervisory authorities to regulate it, and the result would be a somewhat safer system.”

Download:Associated Program:Author(s): -

Macroeconomic Imbalances in the United States and Their Impact on the International Financial System

Working Paper No. 554 | January 2009The argument put forward in this paper is twofold. First, the financial crisis of 2007–08 was made global by the current account deficit in the United States; and second, there is global dependence on the United States trade deficit as a means of maintaining liquidity in financial markets. The outflow of dollars from the United States was invested in US capital markets, causing inflation in asset markets and leading to a bubble and bust in the subprime mortgage sector. Since the US dollar is the international reserve currency, international debt is mostly denominated in dollars. Because there is a high degree of global financial integration, any reduction in the US balance of trade will have negative effects on many countries throughout the world—for example, those countries dependent on exporting to the United States in order to finance their debt.

Download:Associated Program:Author(s):Julia S. Perelstein