Research Topics

Publications on Stock-flow consistent (SFC) modeling

-

A Stock-Flow Ecological Model from a Latin American Perspective

Working Paper No. 1031 | October 2023This study aims to develop an ecological stock-flow consistent (SFC) model based on the Latin American–stylized facts regarding economic, financial, and environmental features. We combine the macro-financial theoretical framework by Pérez-Caldentey et al. (2021, 2023) and the ecological modeling of Carnevali et al. (2020) and Dafermos et al. (2018). We discuss two scenarios that test exogenous climate-related shocks. The first scenario presents the case in which international regulation on commodity trade becomes more stringent due to environmental concerns, thus worsening the balance-of-payment constraint of the region. The second scenario concerns the increase in frequency and intensity of adverse climate events in the region. Both scenarios show that the financial external constraint that determines the growth path of Latin American economies may be further exacerbated due to environmental-related issues.Download:Associated Programs:Author(s):Lorenzo Nalin Giuliano Toshiro Yajima Leonardo Rojas Rodriguez Esteban Pérez Caldentey José Eduardo Alatorre -

When Minsky and Godley Met Structuralism

Working Paper No. 1024 | July 2023A Stock-Flow Consistent Approach to the Currency Hierarchy

Underdevelopment is often conceived as being reproduced domestically. This paper emphasizes the international forces that enable the persistence of underdevelopment. We first explore how the currency hierarchy imposes a dependency relation between developed and underdeveloped economies. We improvise and quantify the currency hierarchy using ratios from the consolidated sovereign balance sheet. Using the improvisation of the currency hierarchy, we identify that a weak currency must compensate its position by resorting to three mechanisms: changes in interest rates, changes in exchange rates, and accumulation of international reserves to improve balance sheet structure. We employ these relationships to formulate two novel, financial post-Keynesian behavioral equations: an international reserves function and a domestic interest rate function. These equations are simulated in a stock-flow consistent model. We simulate the transmission of international shocks and domestic fiscal expansion. The key findings are (1) that the intensity of economic activity in the emerging economy is reliant on the level of economic activity (and policy) i n the developed economy and (2) that any attempts to stimulate—through government spending—the emerging economy benefit primarily the developed economy while harming the emerging economy’s private sector, assuming free capital and goods mobility. This indicates the existence of a balance-of-payment constrained expansion originating from the demand for international reserves as a margin of safety. Simulations show import controls to be a solution. We find government spending complemented by import substitution to be the most appropriate response to a crisis of international origin and suggest the need for international cohesion between emerging economies to create a more conducive international financial and trade system, halting the reproduction of underdevelopment.Download:Associated Program:Author(s):Nitin Nair -

Greece: Recovery, or Another Recession?

Strategic Analysis, October 2022 | October 2022In this strategic analysis, Institute President Dimitri B. Papadimitriou, Senior Scholar Gennaro Zezza, and Research Associate Nikolaos Rodousakis discuss the medium-term prospects for the Greek economy in a time of increasing uncertainty—due to the geopolitical turbulence emanating from the Ukraine–Russian conflict, with its impact on the cost of energy, as well as the increase in international prices of some commodities.

Growth projections for the current year are lower than those recorded in 2021, indicating the economy needs to perform much better if it is to continue on the growth path that began in the pre-pandemic period. Similarly, growth projections for 2023 and 2024 appear much weaker, denoting serious consequences may be in store.

With increasing price levels and the euro depreciating, an economy like Greece’s that is highly dependent on increasingly costly imports will become more fragile as the current account deficit widens. In the authors’ view, the continuous recovery of the Greek economy rests with the government’s ability to utilize the NGEU funds swiftly and efficiently for projects that will increase the country’s productive capacity.

Download:Associated Program:Author(s): -

The Employer of Last Resort Scheme and the Energy Transition

Working Paper No. 995 | November 2021A Stock-Flow Consistent Analysis

The health and economic crises of 2020–21 have revived the debate on fiscal policy as a major tool for stabilization and meeting long-term goals. The massive surge in unemployment, due to the economic disruption of the lockdown measures, has increased the interest in policies that target employment directly instead of trying to achieve it via a general “demand push.” One of the proposals currently under debate is the job guarantee. Under such a policy the government would act as an “employer of last resort” by offering a job to everyone that is able and wants to work but cannot find a job in the private sector. This paper argues that a carefully designed scheme of direct employment and public provision by the state—addressing both the low- and high-skill workforce—can have permanent effects and promote the economy’s structural transformation, in particular by fostering energy transition and a lower carbon footprint. Starting from this point, a stock-flow consistent model is developed to study the long-run effect of the job guarantee’s implementation, inspired by the work of Godin (2013) and Sawyer and Passarella (2021).Download:Associated Programs:Author(s): -

The Pandemic, the Stimulus, and the Future Prospects for the US Economy

Strategic Analysis, June 2021 | June 2021In this report, Institute President Dimitri B. Papadimitriou and Research Scholars Michalis Nikiforos and Gennaro Zezza analyze how the US economy was affected by the pandemic and its prospects for recovery.

Their baseline simulation using the Institute’s stock-flow macroeconometric model shows a significant pickup in the growth rate in 2021 as a result of the American Rescue Plan Act. The report includes two additional scenarios simulated on top of the baseline, finding that President Biden’s infrastructure and families plans—whether paired with offsetting tax increases on high-earners or “deficit financed”—would have positive macroeconomic effects. Additionally, Papadimitriou, Nikiforos, and Zezza warn that if US policymakers do not prioritize decreasing the trade deficit, maintaining growth will require either continuous and very high government deficits or the private sector once again becoming a net borrower.

Finally, they argue that concerns about a sharp increase in inflation spurred by the fiscal stimulus are unwarranted: the US economy was not close to full employment or full utilization of resources before the pandemic, and the propagation mechanisms that could lead to accelerating inflation are not in place.Download:Associated Program:Author(s): -

Restarting the Greek Economy?

Strategic Analysis, May 2021 | May 2021The Greek economy—still fragile due to the lingering effects of the 2009–10 crisis—was hit particularly hard by the COVID-19 pandemic. Greece’s 2020 GDP decline was one of the worst among the group of EU and eurozone member states, along with the highest levels of unemployment and underemployment.

Dimitri B. Papadimitriou, Christos Pierros, Nikos Rodousakis, and Gennaro Zezza update their analysis of the state of the Greek economy on the basis of recently released provisional data for 2020Q4, and model three projections through 2023: (1) a baseline scenario in which no agreement is reached on the disbursement of EU funds (the Recovery and Resilience Facility); (2) a scenario in which EU grants and loans are distributed in a timely manner; and (3) an additional scenario that pairs EU funds with implementation of an employer-of-last resort program. The second scenario would see Greece’s GDP growth return to its pre-pandemic trend—albeit still leaving the economy below the level of real GDP it reached in 2008. The third scenario has the most favorable impact on growth and employment—raising real GDP above its pre-pandemic trend. Failure to achieve a proper recovery of GDP in Greece would be directly related to an absence of fiscal policy expansion.

This Strategic Analysis is the joint product of the Levy Economics Institute of Bard College and INE-GSEE (Athens, Greece). It is simultaneously issued in both English and Greek.Download:Associated Program:Author(s): -

Argentina’s (Macroeconomic?) Trap

Working Paper No. 975 | November 2020Some Insights from an Empirical Stock-Flow Consistent Model

The Argentinean economy has just ended another lost decade. After the peak registered in 2011, the per capita GDP has oscillated with a decreasing trend, leaving the economy poorer than it was ten years before. During these ten years, different governments with conflicting macroeconomic programs were in power, none of them able to save the economy from stagflation. The goal of this paper is to address to what extent the economic performance would have been better had other policy combinations been implemented. The analysis is made through an empirical quarterly stock-flow consistent (SFC) model for the period 2007–19 in order to ensure the coherence of the results and to give the outcomes of the simulations a holistic and dynamically consistent interpretation. From the results of the simulations it seems that the problem that is keeping Argentina in stagflation goes beyond the domain of macroeconomics. The fact that in practice two divergent macroeconomic programs were implemented—neither of them being able to produce good and sustainable macroeconomic performance—is a first symptom that favors the case for that hypothesis. When the model is used to counterfactually test the policy recommendations of these approaches with the external conditions that prevailed while the opposite program was implemented, none of them yield results that can be deemed sustainable. Yet, the model developed in this paper can be useful for studying the different policy combinations that, given a specific context, can bring about more stable and sustainable dynamics for the Argentinean economy.Download:Associated Program:Author(s):Sebastian Valdecantos -

A Stock-Flow Consistent Quarterly Model of the Italian Economy

Working Paper No. 958 | June 2020Macroeconomists and political officers need rigorous, albeit realistic, quantitative models to forecast the future paths and dynamics of some variables of interest while being able to evaluate the effects of alternative scenarios. At the heart of all these models lies a standard macroeconomic module that, depending on the degree of sophistication and the research questions to be answered, represents how the economy works. However, the complete absence of a realistic monetary framework, along with the abstraction of banks and more generally of real–financial interactions—not only in dynamic stochastic general equilibrium (DSGE) models but also in central banks’ structural econometric models—made it impossible to detect the rising financial fragility that led to the Great Recession.

In this paper, we show how to address the missing links between the real and financial sectors within a post-Keynesian framework, presenting a quarterly stock-flow consistent (SFC) structural model of the Italian economy. We set up the accounting structure of the sectoral transactions, describing our “transaction matrix” and “balance sheet matrix,” starting from the appropriate sectoral data sources. We then “close” all sectoral financial accounts, describe portfolio choices, and define the buffer stocks for each class of assets and sector in the model. We describe our estimation strategy, present the main stochastic equations, and, finally, discuss the main channels of transmissions in our model.Download:Associated Program:Author(s): -

A Global Slowdown Will Test US Corporate Fragility

One-Pager No. 61 | March 2020The rapidly growing uncertainty about the potential global fallout from an emerging pandemic is occurring against a background in which there is evidence US corporate sector balance sheets are significantly overstretched, exhibiting a degree of fragility that, according to some measures, is unmatched in the postwar historical record. The US economy is vulnerable to a shock that could trigger a cascade of falling asset prices and private sector deleveraging, with severe consequences for both the real and financial sides of the economy.Download:Associated Program:Author(s): -

A Labor Market–Augmented Empirical Stock-Flow Consistent Model Applied to the Greek Economy

Working Paper No. 949 | February 2020This paper extends the empirical stock-flow consistent (SFC) literature through the introduction of distributional features and labor market institutions in a Godley-type empirical SFC model. In particular, labor market institutions, such as the minimum wage and the collective bargaining coverage rate, are considered as determinants of the wage share and, in turn, of the distribution of national income. Thereby, the model is able to examine both the medium-term stability conditions of the economy via the evolution of the sectoral financial balances and the implications of functional income distribution on the growth prospects of the economy at hand. The model is then applied to the Greek economy. The empirical results indicate that the Greek economy has a significant structural competitiveness deficit, while the institutional regime is likely debt-led. The policies implemented in the context of the economic adjustment programs were highly inappropriate, triggering private sector insolvency. A minimum wage increase is projected to have a positive impact on output growth and employment. However, policies that would enhance the productive sector’s structural competitiveness are required in order to ensure the growth prospects of the Greek economy.Download:Associated Programs:Author(s):Christos Pierros -

Prospects and Challenges for the US Economy

Strategic Analysis, January 2020 | January 20202020 and Beyond

This Strategic Analysis examines the US economy’s prospects for 2020–23 and the risks that lie ahead. The baseline projection generated by the Levy Institute’s stock-flow consistent macroeconomic model shows that, given current fiscal arrangements and the slowdown in the global economy, the pace of the US recovery will slacken somewhat, with a growth rate that will average 1.5 percent over the next several years.

The authors then point to three factors that can derail this already weak baseline trajectory: (1) an overvalued stock market; (2) evidence that the corporate sector’s balance sheets are more fragile than they have ever been in the postwar period; and (3) risks in the foreign sector stemming from the slowdown of the global economy, an overvalued dollar, and the current administration’s erratic trade policy.Download:Associated Program:Author(s): -

An Empirical Stock-Flow Consistent Macroeconomic Model for Denmark

Working Paper No. 942 | January 2020This paper emphasizes the need for understanding the interdependencies between the real and financial sides of the economy in macroeconomic models. While the real side of the economy is generally well explained in macroeconomic models, the financial side and its interaction with the real economy remains poorly understood. This paper makes an attempt to model the interdependencies between the real and financial sides of the economy in Denmark while adopting a stock-flow consistent approach. The model is estimated using Danish data for the period 1995–2016. The model is simulated to create a baseline scenario for the period 2017–30, against which the effects of two standard shocks (fiscal shocks and interest rate shocks) are analyzed. Overall, our model is able to replicate the stylized facts, as will be discussed. While the model structure is fairly simple due to different constraints, the use of the stock-flow approach makes it possible to explain several transmission mechanisms through which real economic behavior can affect the balance sheets, and at the same time capture the feedback effects from the balance sheets to the real economy. Finally, we discuss certain limitations of our model.Download:Associated Programs:Author(s):Mikael Randrup Byrialsen Hamid Raza -

On the Design of Empirical Stock-Flow-Consistent Models

Working Paper No. 919 | January 2019While the literature on theoretical macroeconomic models adopting the stock-flow-consistent (SFC) approach is flourishing, few contributions cover the methodology for building a SFC empirical model for a whole country. Most contributions simply try to feed national accounting data into a theoretical model inspired by Wynne Godley and Marc Lavoie (2007), albeit with different degrees of complexity.

In this paper we argue instead that the structure of an empirical SFC model should start from a careful analysis of the specificities of a country’s sectoral balance sheets and flow of funds data, given the relevant research question to be addressed. We illustrate our arguments with examples for Greece, Italy, and Ecuador.

We also provide some suggestions on how to consistently use the financial and nonfinancial accounts of institutional sectors, showing the link between SFC accounting structures and national accounting rules.Download:Associated Program:Author(s): -

Quantitative Easing and Asset Bubbles in a Stock-flow Consistent Framework

Working Paper No. 897 | September 2017Ever since the Great Recession, central banks have supplemented their traditional policy tool of setting the short-term interest rate with massive buyouts of assets to extend lines of credit and jolt flagging demand. As with many new policies, there have been a range of reactions from economists, with some extolling quantitative easing’s expansionary virtues and others fearing it might invariably lead to overvaluation of assets, instigating economic instability and bubble behavior. To investigate these theories, we combine elements of the models in chapters 5, 10, and 11 of Godley and Lavoie’s (2007) Monetary Economics with equations for quantitative easing and endogenous bubbles in a new model. By running the model under a variety of parameters, we study the causal links between quantitative easing, asset overvaluation, and macroeconomic performance. Preliminary results suggest that rather than being pro- or countercyclical, quantitative easing acts as a sort of phase shift with respect to time.

-

The Trump Effect: Is This Time Different?

Strategic Analysis, April 2017 | April 2017From a macroeconomic point of view, 2016 was an ordinary year in the post–Great Recession period. As in prior years, the conventional forecasts predicted that this would be the year the economy would finally escape from the “new normal” of secular stagnation. But just as in every previous year, the forecasts were confounded by the actual result: lower-than-expected growth—just 1.6 percent.

The radical policy changes promoted by the new Trump administration dominated economic conditions in the closing quarter of the year and the first quarter of 2017. Markets have responded with exuberance since the November elections, on the expectation that the proposed policy measures would increase profitability by boosting growth and cutting personal and corporate taxes. However, an evaluation of the US economy’s structural characteristics reveals three key impediments to a robust, sustainable recovery: income inequality, fiscal conservatism, and weak net export demand. The new administration’s often conflicting policy proposals are unlikely to solve any of these fundamental problems—if anything, the situation will worsen.

Our latest Strategic Analysis provides two medium-term scenarios for the US economy. The “business as usual” baseline scenario (built on CBO estimates) shows household debt and GDP growth roughly maintaining their moribund postcrisis trends. The second scenario assumes a sharp correction in the stock market beginning in 2017Q3, combined with another round of private sector deleveraging. The results: negative growth and a government deficit of 8.3 percent by 2020—essentially a repeat of the crisis of 2007–9.Download:Associated Program:Author(s): -

Destabilizing an Unstable Economy

Strategic Analysis, March 2016 | March 2016Our latest strategic analysis reveals that the US economy remains fragile because of three persistent structural issues: weak demand for US exports, fiscal conservatism, and a four-decade trend in rising income inequality. It also faces risks from stagnation in the economies of the United States’ trading partners, appreciation of the dollar, and a contraction in asset prices. The authors provide a baseline and three alternative medium-term scenarios using the Levy Institute’s stock-flow consistent macro model: a dollar appreciation and reduced growth in US trading partners scenario; a stock market correction scenario; and a third scenario combining scenarios 1 and 2. The baseline scenario shows that future growth will depend on an increase in private sector indebtedness, while the remaining scenarios underscore the linkages between a fragile US recovery and instability in the global economy.Download:Associated Program:Author(s): -

The Roads Not Taken

Working Paper No. 854 | November 2015Graph Theory and Macroeconomic Regimes in Stock-flow Consistent Modeling

Standard presentations of stock-flow consistent modeling use specific Post Keynesian closures, even though a given stock-flow accounting structure supports various different economic dynamics. In this paper we separate the dynamic closure from the accounting constraints and cast the latter in the language of graph theory. The graph formulation provides (1) a representation of an economy as a collection of cash flows on a network and (2) a collection of algebraic techniques to identify independent versus dependent cash-flow variables and solve the accounting constraints. The separation into independent and dependent variables is not unique, and we argue that each such separation can be interpreted as an institutional structure or policy regime. Questions about macroeconomic regime change can thus be addressed within this framework.

We illustrate the graph tools through application of the simple stock-flow consistent model, or “SIM model,” found in Godley and Lavoie (2007). In this model there are eight different possible dynamic closures of the same underlying accounting structure. We classify the possible closures and discuss three of them in detail: the “standard” Godley–Lavoie closure, where government spending is the key policy lever; an “austerity” regime, where government spending adjusts to taxes that depend on private sector decisions; and a “colonial” regime, which is driven by taxation.

Download:Associated Programs:Author(s):Miguel Carrión Álvarez Dirk Ehnts -

Money Creation under Full-reserve Banking

Working Paper No. 851 | October 2015A Stock-flow Consistent Model

This paper presents a stock-flow consistent model+ of full-reserve banking. It is found that in a steady state, full-reserve banking can accommodate a zero-growth economy and provide both full employment and zero inflation. Furthermore, a money creation experiment is conducted with the model. An increase in central bank reserves translates into a two-thirds increase in demand deposits. Money creation through government spending leads to a temporary increase in real GDP and inflation. Surprisingly, it also leads to a permanent reduction in consolidated government debt. The claims that full-reserve banking would precipitate a credit crunch or excessively volatile interest rates are found to be baseless.

Download:Associated Program:Author(s):Patrizio Lainà -

Inside Money in a Kaldor-Kalecki-Steindl Fiscal Policy Model

Working Paper No. 839 | June 2015The Unit of Account, Inflation, Leverage, and Financial Fragility

We hope to model financial fragility and money in a way that captures much of what is crucial in Hyman Minsky’s financial fragility hypothesis. This approach to modeling Minsky may be unique in the formal Minskyan literature. Namely, we adopt a model in which a psychological variable we call financial prudence (P) declines over time following a financial crash, driving a cyclical buildup of leverage in household balance sheets. High leverage or a low safe-asset ratio in turn induces high financial fragility (FF). In turn, the pathways of FF and capacity utilization (u) determine the probabilistic risk of a crash in any time interval. When they occur, these crashes entail discrete downward jumps in stock prices and financial sector assets and liabilities. To the endogenous government liabilities in Hannsgen (2014), we add common stock and bank loans and deposits. In two alternative versions of the wage-price module in the model (wage–Phillips curve and chartalist, respectively), the rate of wage inflation depends on either unemployment or the wage-setting policies of the government sector. At any given time t, goods prices also depend on endogenous markup and labor productivity variables. Goods inflation affects aggregate demand through its impact on the value of assets and debts. Bank rates depend on an endogenous markup of their own. Furthermore, in light of the limited carbon budget of humankind over a 50-year horizon, goods production in this model consumes fossil fuels and generates greenhouse gases.

The government produces at a rate given by a reaction function that pulls government activity toward levels prescribed by a fiscal policy rule. Subcategories of government spending affect the pace of technical progress and prudence in lending practices. The intended ultimate purpose of the model is to examine the effects of fiscal policy reaction functions, including one with dual unemployment rate and public production targets, testing their effects on numerically computed solution pathways. Analytical results in the penultimate section show that (1) the model has no equilibrium (steady state) for reasons related to Minsky’s argument that modern capitalist economies possess a property that he called “the instability of stability,” and (2) solution pathways exist and are unique, given vectors of initial conditions and parameter values and realizations of the Poisson model of financial crises.

Download:Associated Program:Author(s): -

Greece: Conditions and Strategies for Economic Recovery

Strategic Analysis, May 2015 | May 2015The Greek economy has the potential to recover, and in this report we argue that access to alternative financing sources such as zero-coupon bonds (“Geuros”) and fiscal credit certificates could provide the impetus and liquidity needed to grow the economy and create jobs. But there are preconditions: the existing government debt must be rolled over and austerity policies put aside, restoring trust in the country’s economic future and setting the stage for sustainable income growth, which will eventually enable Greece to repay its debt.

Download:Associated Program:Author(s): -

Fiscal Austerity, Dollar Appreciation, and Maldistribution Will Derail the US Economy

Strategic Analysis, May 2015 | May 2015In this latest Strategic Analysis, the Institute’s Macro Modeling Team examines the current, anemic recovery of the US economy. The authors identify three structural obstacles—the weak performance of net exports, a prevailing fiscal conservatism, and high income inequality—that, in combination with continued household sector deleveraging, explain the recovery’s slow pace. Their baseline macro scenario shows that the Congressional Budget Office’s latest GDP growth projections require a rise in private sector spending in excess of income—the same unsustainable path that preceded both the 2001 recession and the Great Recession of 2007–9. To better understand the risks to the US economy, the authors also examine three alternative scenarios for the period 2015–18: a 1 percent reduction in the real GDP growth rate of US trading partners, a 25 percent appreciation of the dollar over the next four years, and the combined impact of both changes. All three scenarios show that further dollar appreciation and/or a growth slowdown in the trading partner economies will lead to an increase in the foreign deficit and a decrease in the projected growth rate, while heightening the need for private (and government) borrowing and adding to the economy’s fragility.Download:Associated Program:Author(s): -

Is Greece Heading For a Recovery?

Strategic Analysis, December 2014 | December 2014With the anti-austerity Syriza party continuing to lead in polls ahead of Greece’s election on January 25, what is the outlook for restoring growth and increasing employment following six years of deep recession? Despite some timid signs of recovery, notably in the tourism sector, recent short-term indicators still show a decline for 2014. Our analysis shows that the speed of a market-driven recovery would be insufficient to address the urgent problems of poverty and unemployment. And the protracted austerity required to service Greece’s sovereign debt would merely ensure the continuation of a national crisis, with spillover effects to the rest of the eurozone—especially now, when the region is vulnerable to another recession and a prolonged period of Japanese-style price deflation. Using the Levy Institute’s macroeconometric model for Greece, we evaluate the impact of policy alternatives aimed at stimulating the country’s economy without endangering its current account, including capital transfers from the European Union, suspension of interest payments on public debt and use of these resources to boost demand and employment, and a New Deal plan using public funds to target investment in production growth and finance a direct job creation program.Download:Associated Program:Author(s): -

The Political Economy of Shadow Banking

Working Paper No. 801 | May 2014Debt, Finance, and Distributive Politics under a Kalecki-Goodwin-Minsky SFC Framework

This paper describes the political economy of shadow banking and how it relates to the dramatic institutional changes experienced by global capitalism over past 100 years. We suggest that the dynamics of shadow banking rest on the distributive tension between workers and firms. Politics wedge the operation of the shadow financial system as government policy internalizes, guides, and participates in dealings mediated by financial intermediaries. We propose a broad theoretical overview to formalize a stock-flow consistent (SFC) political economy model of shadow banking (stylized around the operation of money market mutual funds, or MMMFs). Preliminary simulations suggest that distributive dynamics indeed drive and provide a nest for the dynamics of shadow banking.

Download:Associated Programs:Author(s):Eloy Fisher Javier López Bernardo -

Is Rising Inequality a Hindrance to the US Economic Recovery?

Strategic Analysis, April 2014 | April 2014The US economy has been expanding moderately since the official end of the Great Recession in 2009. The budget deficit has been steadily decreasing, inflation has remained in check, and the unemployment rate has fallen to 6.7 percent. The restrictive fiscal policy stance of the past three years has exerted a negative influence on aggregate demand and growth, which has been offset by rising domestic private demand; net exports have had only a negligible (positive) effect on growth. As Wynne Godley noted in 1999, in the Strategic Analysis Seven Unsustainable Processes, if an economy faces sluggish net export demand and fiscal policy is restrictive, economic growth becomes dependent on the private sector’s continuing to spend in excess of its income. However, this continuous excess is not sustainable in the medium and long run. Therefore, if spending were to stop rising relative to income, without either fiscal relaxation or a sharp recovery in net exports, the impetus driving the expansion would evaporate and output could not grow fast enough to stop unemployment from rising. Moreover, because growth is so dependent on “rising private borrowing,” the real economy “is at the mercy of the stock market to an unusual extent.” As proved by the crisis of 2001 and the Great Recession of 2007–09, Godley’s analysis turned out to be correct. Fifteen years later, the US economy appears to be going down the same road again. Postrecession, foreign demand is still weak and the government is maintaining its tight fiscal stance. Once again, the recovery predicted in the latest Congressional Budget Office report relies on excessive private sector borrowing, and once again, the recovery is at the mercy of the stock market. Given that the income distribution has worsened since the crisis—continuing a 35-year trend—the burden of indebtedness will again fall disproportionally on the middle class and the poor. In order for the CBO projections to materialize, households in the bottom 90 percent of the distribution would have to start accumulating debt again in line with the prerecession trend while the stock of debt of the top 10 percent remained at its present level. Clearly, this process is unsustainable. The United States now faces a choice between two undesirable outcomes: a prolonged period of low growth—secular stagnation—or a bubble-fueled expansion that will end with a serious financial and economic crisis. The only way out of this dilemma is a reversal of the trend toward greater income inequality.Download:Author(s): -

Prospects and Policies for the Greek Economy

Strategic Analysis, February 2014 | February 2014In this report, we discuss alternative scenarios for restoring growth and increasing employment in the Greek economy, evaluating alternative policy options through our specially constructed macroeconometric model (LIMG). After reviewing recent events in 2013 that confirm our previous projections for an increase in the unemployment rate, we examine the likely impact of four policy options: (1) external help through Marshall Plan–type capital transfers to the government; (2) suspension of interest payments on public debt, instead using these resources for increasing demand and employment; (3) introduction of a parallel financial system that uses new government bonds; and (4) adoption of an employer-of-last-resort (ELR) program financed through the parallel financial system. We argue that the effectiveness of the different plans crucially depends on the price elasticity of the Greek trade sector. Since our analysis shows that such elasticity is low, our ELR policy option seems to provide the best strategy for a recovery, having immediate effects on the Greek population's standard of living while containing the effects on foreign debt.Download:Associated Program:Author(s): -

Rescuing the Recovery: Prospects and Policies for the United States

Strategic Analysis, October 2013 | October 2013If the Congressional Budget Office’s recent projections of government revenues and outlays come to pass, the United States will not grow fast enough to bring down the unemployment rate between now and 2016. The public sector deficit will decline from present levels, endangering the sustainability of the recovery. But as this new Strategic Analysis shows, a public sector stimulus of a little over 1 percent of GDP per year focused on export-oriented R & D investment would increase US competitiveness through export-price effects, resulting in a rise of net exports, and slowly lower unemployment to less than 5 percent by 2016. The improvement in net export demand would allow the US economy to enter a period of aggregate-demand rehabilitation—with very encouraging consequences at home.Download:Associated Program:Author(s): -

A Levy Institute Model for Greece

Research Project Report, July 2013 | July 2013Technical Paper

In this report Levy Institute President Dimitri B. Papadimitriou and Research Scholars Gennaro Zezza and Michalis Nikiforos present the technical structure of the Levy Institute's macroeconomic model for the Greek economy (LIMG). LIMG is a stock-flow consistent model that reflects the “New Cambridge” approach that builds on the work of Distinguished Scholar Wynne Godley and the current Levy Institute model for the US economy. LIMG is a flexible tool for the analysis of economic policy alternatives for the medium term and is also the analytic framework for a forthcoming Strategic Analysis series focusing on the Greek economy.Download:Associated Program:Author(s): -

The Greek Economic Crisis and the Experience of Austerity

Strategic Analysis, July 2013 | July 2013A Strategic Analysis

Employment in Greece is in free fall, with more than one million jobs lost since October 2008—a drop of more than 28 percent. In March, the “official” unemployment rate was 27.4 percent, the highest level seen in any industrialized country in the free world during the last 30 years.

In this report, Levy Institute President Dimitri B. Papadimitriou and Research Scholars Michalis Nikiforos and Gennaro Zezza present their analysis of Greece’s economic crisis and offer policy recommendations to restore growth and increase employment. This analysis relies on the Levy Institute’s macroeconomic model for the Greek economy (LIMG), a stock-flow consistent model similar to the Institute’s model of the US economy. Based on the LIMG simulations, the authors find that a continuation of “expansionary austerity” policies will actually increase unemployment, since GDP will not grow quickly enough to arrest, much less reverse, the decline in employment. They critically evaluate recent International Monetary Fund and European Commission projections for the Greek economy, and find these projections overly optimistic. They recommend a recovery plan, similar to the Marshall Plan, to increase public consumption and investment. Toward this end, the authors call for an expanded direct public-service job creation program.Download:Associated Program:Author(s): -

Is the Link between Output and Jobs Broken?

Strategic Analysis, March 2013 | March 2013

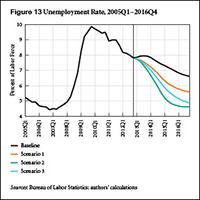

As this report goes to press, the official unemployment rate remains tragically elevated, compared even to rates at similar points in previous recoveries. The US economy seems once again to be in a “jobless recovery,” though the unemployment rate has been steadily declining for years. At the same time, fiscal austerity has arrived, with the implementation of the sequester cuts, following tax increases and the ending of emergency extended unemployment benefits just two months ago.

Our new report provides medium-term projections of employment and economic growth under four different scenarios. The baseline scenario starts by assuming the same growth rates and government deficits as the Congressional Budget Office’s (CBO) baseline projection from earlier this year. The result is a new surge of the unemployment rate to nearly 8 percent in the third quarter of this year, followed by a very gradual new recovery. Scenarios 1 and 2 seek to reach unemployment-rate goals of 6.5 percent and 5.5 percent, respectively, by the end of next year, using new fiscal stimulus.

We find in these simulations that reaching the goals requires large amounts of fiscal stimulus, compared to the CBO baseline. For example, in order to reach 5.5 percent unemployment in 2014, scenario 2 assumes 11 percent growth in inflation-adjusted government spending and transfers, along with lower taxes.

As an alternative, scenario 3 adds an extra increase to growth abroad and to private borrowing, along with the same amount of fiscal stimulus as in scenario 1. In this last scenario of the report, the unemployment rate finally pierces the 5.5 percent threshold from the previous scenario in the third quarter of 2015. We conclude with some thoughts about how such an increase in demand from all three sectors—government, private, and external—might be realistically obtained.

Download:Associated Program:Author(s): -

The Missing Macro Link

Working Paper No. 753 | February 2013This paper addresses the critique of the aggregational problem attached to the financial instability hypothesis of Hyman Minsky. The core of this critique is based on the Kaleckian analytical framework and, in very broad terms, states that the expenditure of firms for investment is at the same time a source of income for the firms producing capital goods. Hence, even if investments are debt financed, as in Minsky’s analysis, the overall level of indebtedness of the firm sector remains unchanged, since the debts of investing firms are balanced by the income of capital goods–producing firms. According to the critics, Minsky incurs a fallacy of composition when he does not take this dynamic into account when applying his micro analysis of investment at the macro level. The aim of this paper is to clarify the consequences of debt-financed investments over the financial structure of an aggregate economy. Starting from the works of Michał Kalecki and Josef Steindl, we developed a stock-flow consistent analysis of a highly simplified economy under four different financial regimes: (1) debt-financed with no distributed profits, (2) debt-financed with distributed profits, (3) internally financed with no distributed profits, and (4) internally financed with distributed profits. The results of our investigation show that debt-financed investments do not lead to a worsening of the financial position of the firm sector only if specific assumptions are taken into account.

Download:Associated Program:Author(s):Eugenio Caverzasi -

Stock-flow Consistent Modeling through the Ages

Working Paper No. 745 | January 2013The aim of the paper is to provide an overview of the current stock-flow consistent (SFC) literature. Indeed, we feel the SFC approach has recently led to a blossoming literature, requiring a new summary after the work of Dos Santos (2006) and, above all, after the publication of the main reference work on the methodology, Godley and Lavoie’s Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth (2007). The paper is developed along the following lines. First, a brief historical analysis investigates the roots of this class of models that can be traced as far back as 1949 and the work of Copeland. Second, the competing points of view regarding some of its main controversial aspects are underlined and used to classify the different methodological approaches followed in using these models. Namely, we discuss (1) how the models are solved, (2) the treatment of time and its implication, and (3) the need—or not—of microfoundations. These results are then used in the third section of the paper to develop a bifocal perspective, which allows us to divide the literature reviewed according to both its subject and the methodology. We explore various topics such as financialization, exchange rate modeling, policy implication, the need for a common framework within the post-Keynesian literature, and the empirical use of SFC models. Finally, the conclusions present some hypotheses (and wishes) over the possible lines of development of the stock-flow consistent models.

Download:Associated Program:Author(s):Eugenio Caverzasi Antoine Godin -

Innovation and Finance

Working Paper No. 733 | October 2012An SFC Analysis of Great Surges of Development

Schumpeter, a century ago, argued that boom-and-bust cycles are intrinsically related to the functioning of a capitalistic economy. These cycles, inherent to the rise of innovation, are an unavoidable consequence of the way in which markets evolve and assimilate successive technological revolutions. Furthermore, Schumpeter’s analysis stressed the fundamental role played by finance in fostering innovation, in defining bank credit as the “monetary complement” of innovation. Nevertheless, we feel that the connection between innovation and firm financing has seldom been examined from a theoretical standpoint, not only by economists in general, but even within the Neo-Schumpeterian research line. Our paper aims at analyzing both the long-term structural change process triggered by innovation and the related financial dynamics inside the coherent framework provided by the stock-flow consistent (SFC) approach. The model presents a multisectoral economy composed of consumption and capital goods industries, a banking sector, and two household sectors: capitalists and wage earners. The SFC approach helps us to track the flows of funds resulting from the rise of innovators in the system. The dynamics of prices, employment, and wealth distribution among the different sectors and social groups is analyzed. Above all, the essential role of finance in fostering innovation and its interaction with the real economy is underlined.

Download:Associated Program:Author(s):Alessandro Caiani Antoine Godin Stefano Lucarelli -

Contributions in Stock-flow Modeling: Essays in Honor of Wynne Godley

Book Series | June 2012Edited by Dimitri B. Papadimitriou and Gennaro Zezza

In the 1970s, at a time of shock, controversy and uncertainty over the direction of monetary and fiscal policy, Wynne Godley and the Cambridge Department of Applied Economics rose to prominence, challenging the accepted Keynesian wisdom of the time. This collection of essays brings together eminent scholars who have been influenced by Godley's enormous contribution to the field of monetary economics and macroeconomic modeling.

Godley's theoretical, applied and policy work is explored in detail, including an analysis of the insightful New Cambridge 'three balances' model, and its use in showing the progression of real capitalist economies over time. Godley's prescient concerns about the global financial crash are also examined, demonstrating how his work revealed structural imbalances and formed the foundations of an economics relevant to the instability of finance.

Published By: Palgrave MacMillan

Associated Program:Author(s): -

Guaranteed Green Jobs

Working Paper No. 722 | May 2012Sustainable Full Employment

In most economies, the potential of saving energy via insulation and more efficient uses of electricity is important. In order to reach the Kyoto Protocol objectives, it is urgent to develop policies that reduce the production of carbon dioxide in all sectors of the economy. This paper proposes an analysis of a green-jobs employer-of-last-resort (ELR) program based on a stock-flow consistent (SFC) model with three productive sectors (consumption, capital goods, and energy) and two household sectors (wage earners and capitalists). By increasing the energy efficiency of dwellings and public buildings, the green-jobs ELR sector implies a shift in consumption patterns from energy consumption toward consumption of goods. This could spur the private sector and thus increase employment. Lastly, the jobs guarantee program removes all involuntary unemployment and decreases poverty while lowering carbon dioxide emissions. The environmental policy proposed in this paper is macroeconomic and offers a structural change of the economy instead of the usual micro solutions.

Download:Associated Program:Author(s):Antoine Godin -

Back to Business as Usual? Or a Fiscal Boost?

Strategic Analysis, April 2012 | April 2012Though the economy appears to be gradually gaining momentum, broad measures indicate that 14.5 percent of the US labor force is unemployed or underemployed, not much below the 16.2 percent rate reached a full year ago. In this new report in our Strategic Analysis series, we first discuss several slow-moving factors that make it difficult to achieve a full and sustainable economic recovery: the gradual redistribution of income toward the wealthiest 1 percent of households; a failure to fully stabilize and reregulate finance; serious fiscal troubles for state and local governments; and detritus from the financial crisis that remains on household and corporate balance sheets. These factors contribute to a situation in which employment has not risen fast enough since the (supposed) end of the recession to significantly increase the employment-population ratio. Meanwhile, public investment at all levels of government fell from roughly 3.7 percent of GDP in 2008 to 3.2 percent in the fourth quarter of 2011, helping to explain the weak economic picture.

For this report, we use the Levy Institute macro model to simulate the economy under the following three scenarios: (1) a private borrowing scenario, in which we find the appropriate amount of private sector net borrowing/lending to achieve the path of employment growth projected under current policies by the Congressional Budget Office (CBO), in a report characterized by excessive optimism and a bias toward deficit reduction; (2) a more plausible scenario, in which we assume that the federal government extends certain key tax cuts and that household borrowing increases at a more reasonable rate than in the previous scenario; and (3) a fiscal stimulus scenario, in which we simulate the effects of a fully “paid for” 1 percent increase in government investment.

The results show the importance of debt accumulation as a consideration in macro policymaking. The first scenario reproduces the CBO’s relatively optimistic employment projections, but our results indicate that this private-sector-led growth scenario quickly brings household and business debt to new all-time highs as percentages of GDP. We note that the CBO makes its projections using an orthodox model with several common, but fundamental, flaws. This makes possible the agency’s result that current policies will reduce the unemployment rate without a run-up in the private sector’s debt—“business as usual,” in the words of our report’s title.

The policies weighed in the second scenario do not perform much better, despite a looser fiscal stance. Finally, our third scenario illustrates that a small, tax-financed increase in government investment could lower the unemployment rate significantly—by about one-half of 1 percent. A stimulus package of this size might be within the realm of political possibility at this juncture. However, our results lead us to surmise that it would take a much more substantial fiscal stimulus to reduce unemployment to a level that most policymakers would regard as acceptable.

Download:Associated Program:Author(s): -

Is the Recovery Sustainable?

Strategic Analysis, December 2011 | December 2011Fiscal austerity is now a worldwide phenomenon, and the global growth slowdown is highly unfavorable for policymakers at the national level. According to our Macro Modeling Team's baseline forecast, fears of prolonged stagnation and a moribund employment market are well justified. Assuming no change in the value of the dollar or interest rates, and deficit levels consistent with the Congressional Budget Office’s most recent “no-change” scenario, growth will remain very weak through 2016 and unemployment will exceed 9 percent.

In an alternate scenario, the authors simulate the effect of new austerity measures that are commensurate with the implementation of large federal budget cuts. Here, growth falls to 0.06 percent in the second quarter of 2014 before leveling off at approximately 1 percent and unemployment rises to 10.7 percent by the end of 2016. In their fiscal stimulus scenario, real GDP growth increases very quickly, unemployment declines to 7.2 percent, and the US current account balance reaches 1.9 percent by the end of 2016—with a debt-to-GDP ratio that, at 97.4 percent, is only slightly higher than in the baseline scenario.

An export-led growth strategy may accomplish little more than drawing a small number of scarce customers away from other exporting nations, and the authors expect no net contribution to aggregate demand growth from the financial sector. A further fiscal stimulus is clearly in order, they say, but an ill-timed round of fiscal austerity could result in a perilous situation for Washington.

Download:Associated Program:Author(s): -

Causes of Financial Instability

Working Paper No. 665 | April 2011Don’t Forget Finance

Given the economy’s complex behavior and sudden transitions as evidenced in the 2007–08 crisis, agent-based models are widely considered a promising alternative to current macroeconomic practice dominated by DSGE models. Their failure is commonly interpreted as a failure to incorporate heterogeneous interacting agents. This paper explains that complex behavior and sudden transitions also arise from the economy’s financial structure as reflected in its balance sheets, not just from heterogeneous interacting agents. It introduces “flow-of-funds” and “accounting” models, which were preeminent in successful anticipations of the recent crisis. In illustration, a simple balance-sheet model of the economy is developed to demonstrate that nonlinear behavior and sudden transition may arise from the economy’s balance-sheet structure, even without any microfoundations. The paper concludes by discussing one recent example of combining flow-of-funds and agent-based models. This appears a promising avenue for future research.

Download:Associated Programs:Author(s):Dirk Bezemer -

Jobless Recovery Is No Recovery: Prospects for the US Economy

Strategic Analysis, March 2011 | March 2011The US economy grew reasonably fast during the last quarter of 2010, and the general expectation is that satisfactory growth will continue in 2011–12. The expansion may, indeed, continue into 2013. But with large deficits in both the government and foreign sectors, satisfactory growth in the medium term cannot be achieved without a major, sustained increase in net export demand. This, of course, cannot happen without either a cut in the domestic absorption of US goods and services or a revaluation of the currencies of the major US trading partners.

Our policy message is fairly simple, and one that events over the years have tended to vindicate. Most observers have argued for reductions in government borrowing, but few have pointed out the potential instabilities that could arise from a growth strategy based largely on private borrowing—as the recent financial crisis has shown. With the economy operating at far less than full employment, we think Americans will ultimately have to grit their teeth for some hair-raising deficit figures, but they should take heart in recent data showing record-low “core” CPI inflation—and the potential for export-led growth to begin reducing unemployment.

Download:Associated Program:Author(s): -

Revisiting “New Cambridge”: The Three Financial Balances in a General Stock-flow Consistent Applied Modeling Strategy

Working Paper No. 594 | May 2010This paper argues that modified versions of the so-called “New Cambridge” approach to macroeconomic modeling are both quite useful for modeling real capitalist economies in historical time and perfectly compatible with the “vision” underlying modern Post-Keynesian stock-flow consistent macroeconomic models. As such, New Cambridge–type models appear to us as an important contribution to the tool kit available to applied macroeconomists in general, and to heterodox applied macroeconomists in particular. -

Getting Out of the Recession?

Strategic Analysis, March 2010 | March 2010Research Scholar Gennaro Zezza updates the Levy Institute’s previous Strategic Analysis (December 2009) and finds that the 2009 increase in public sector aggregate demand was a result of the fiscal stimulus, without which the recession would have been much deeper. He confirms that strong policy action is required to achieve full employment in the medium term, including a persistently high government deficit in the short term. This implies a growing public debt, which is sustainable as long as interest rates are kept at the current low level. The alternative is an ongoing unemployment rate above 10 percent that would represent a higher cost to future generations.Download:Associated Program:Author(s): -

Sustaining Recovery: Medium-term Prospects and Policies for the US Economy

Strategic Analysis, December 2009 | December 2009Though recent market activity and housing reports give some warrant for optimism, United States economic growth was only 2.8 percent in the third quarter, and the unemployment rate is still very high. In their new Strategic Analysis, the Levy Institute’s Macro-Modeling Team project that high unemployment will continue to be a problem if fiscal stimulus policies expire and deficit reduction efforts become the policy focus. The authors—President Dimitri B. Papadimitriou and Research Scholars Greg Hannsgen and Gennaro Zezza—argue that continued fiscal stimulus is necessary to reduce unemployment. The resulting federal deficits would be sustainable, they say, as long as they were accompanied by a coordinated and gradual devaluation of the dollar, especially against undervalued Asian currencies—a step necessary to prevent an increase in the current account deficit and ward off the risk of a currency crash.

Download:Associated Program:Author(s): -

Revisiting (and Connecting) Marglin-Bhaduri and Minsky

Working Paper No. 567 | June 2009An SFC Look at Financialization and Profit-led Growth

Many heterodox strands of thought share both a concern with the study of different phases or growth regimes in the history of capitalism and the use of formal short-run models as an analytical tool. The authors of this new working paper suggest (1) that this strategy is potentially misleading, and (2) that the stock-flow consistent (SFC) approach, while providing a general framework that may facilitate dialogue among those currents, is particularly well suited to all those who think that macroeconomic models may illuminate historical quests.

-

Recent Rise in Federal Government and Federal Reserve Liabilities: Antidote to a Speculative Hangover

Strategic Analysis, April 2009 | April 2009Federal government and Federal Reserve (Fed) liabilities rose sharply in 2008. Who holds these new liabilities, and what effects will they have on the economy? Some economists and politicians warn of impending inflation. In this new Strategic Analysis, the Levy Institute’s Macro-Modeling Team focuses on one positive effect—a badly needed improvement of private sector balance sheets—and suggest some of the reasons why it is unlikely that the surge in Fed and federal government liabilities will cause excessive inflation.

Download:Associated Program:Author(s): -

Flow of Funds Figures Show the Largest Drop in Household Borrowing in the Last 40 Years

Strategic Analysis, January 2009 | January 2009The Federal Reserve’s latest flow-of-funds data reveal that household borrowing has fallen sharply lower, bringing about a reversal of the upward trend in household debt. According to the Levy Institute’s macro model, a fall in borrowing has an immediate effect—accounting in this case for most of the 3 percent drop in private expenditure that occurred in the third quarter of 2008—as well as delayed effects; as a result, the decline in real GDP and accompanying rise in unemployment may be substantial in coming quarters.

For further details on the Macro-Modeling Team’s latest projections, see the December 2008 Strategic Analysis Prospects for the US and the World: A Crisis That Conventional Remedies Cannot Resolve.

Download:Associated Program:Author(s): -

Prospects for the United States and the World: A Crisis That Conventional Remedies Cannot Resolve

Strategic Analysis, December 2008 | December 2008The economic recovery plans currently under consideration by the United States and many other countries seem to be concentrated on the possibility of using expansionary fiscal and monetary policies alone. In a new Strategic Analysis, the Levy Institute’s Macro-Modeling Team argues that, however well coordinated, this approach will not be sufficient; what’s required, they say, is a worldwide recovery of output, combined with sustainable balances in international trade.

Download:Associated Program:Author(s): -

Fiscal Stimulus—Is More Needed?

Strategic Analysis, April 2008 | April 2008As the government prepares to dispense the tax rebates that largely make up its recently approved $168 billion stimulus package, President Dimitri B. Papadimitriou and Research Scholars Greg Hannsgen and Gennaro Zezza explore the possibility of an additional fiscal stimulus of about $450 billion spread over three quarters—challenging the notion that a larger and more prolonged additional stimulus is unnecessary and will generate inflationary pressures. They find that, given current projections of even a moderate recession, a fiscal stimulus totaling $600 billion would not be too much. They also find that a temporary stimulus—even one lasting four quarters—will have only a temporary effect. An enduring recovery will depend on a prolonged increase in exports, the authors say, due to the weak dollar, a modest increase in imports, and the closing of the current account gap.

Download:Associated Program:Author(s): -

The US Economy: What's Next?

Strategic Analysis, April 2007 | April 2007The collapse in the subprime mortgage market, along with multiple signals of distress in the broader housing market, has already drawn forth a large body of comment. Some people think the upheaval will turn out to be contagious, causing a major slowdown or even a recession later in 2007. Others believe that the turmoil will be contained, and that the US economy will recover quite rapidly and resume the steady growth it has enjoyed during the last four years or so.

Yet no participants in the public discussion, so far as we know, have framed their views in the context of a formal model that enables them to draw well-argued conclusions (however conditional) about the magnitude and timing of the impact of recent events on the overall economy in the medium term—not just the next few months.

Download:Associated Program:Author(s): -

Can Global Imbalances Continue?

Strategic Analysis, November 2006 | November 2006Policies for the U.S. Economy

In this new Strategic Analysis, we review what we believe is the most important economic policy issue facing policymakers in the United States and abroad: the prospect of a growth recession in the United States. The possibility of recession is linked to the imbalances in the current account, government, and private sector deficits. The current account balance, which is a negative addition to US aggregate demand, is now likely to be above 6.5 percent of GDP and has been rising steadily for some time. The government balance has improved, again giving no stimulus to demand, which has therefore relied entirely on a large and growing private sector deficit. A rapidly cooling housing market is one of the signs showing that this growth path is likely to break down.

We focus first on the current account deficit. Our analysis suggests that a necessary and sufficient condition to address this problem, without dire consequences for unemployment and growth, is that net export demand grow by a sufficient amount. For this to happen, three conditions need to be satisfied: foreign saving has to fall, especially in Europe and East Asia; US saving has to rise; and some mechanism, such as a change in relative prices, should be put in place to help the previous two phenomena translate into an improvement in the US balance of trade.

Download:Associated Program:Author(s):