Research Topics

Publications on Fiscal austerity

-

How Long Before Growth and Employment Are Restored in Greece?

Strategic Analysis, January 2016 | January 2016The Greek economy has not succeeded in restoring growth, nor has it managed to restore a climate of reduced uncertainty, which is crucial for stabilizing the business climate and promoting investment. On the contrary, the new round of austerity measures that has been agreed upon implies another year of recession in 2016.

After reviewing some recent indicators for the Greek economy, we project the trajectory of key macroeconomic indicators over the next three years. Our model shows that a slow recovery can be expected beginning in 2017, at a pace that is well below what is needed to alleviate poverty and reduce unemployment. We then analyze the impact of a public investment program financed by European institutions, of a size that is feasible given the current political and economic conditions, and find that, while such a plan would help stimulate the economy, it would not be sufficient to speed up the recovery. Finally, we revise our earlier proposal for a fiscal stimulus financed through the emission of a complementary currency targeted to job creation. Our model shows that such a plan, calibrated in a way that avoids inflationary pressures, would be more effective—without disrupting the targets the government has agreed upon in terms of its primary surplus, and without reversing the improvement in the current account.Download:Associated Program:Author(s): -

Will Tourism Save Greece?

Strategic Analysis, August 2014 | August 2014What are the prospects for economic recovery if Greece continues to follow the troika strategy of fiscal austerity and internal devaluation, with the aim of increasing competitiveness and thus net exports? Our latest strategic analysis indicates that the unprecedented decline in real and nominal wages may take a long time to exert its effects on trade—if at all—while the impact of lower prices on tourism will not generate sufficient revenue from abroad to meet the targets for a surplus in the current account that outweighs fiscal austerity. The bottom line: a shift in the fiscal policy stance, toward lower taxation and job creation, is urgently needed.Download:Associated Program:Author(s): -

The Myth of the Greek Economic “Success Story”

Policy Note 2014/3 | February 2014In 2001, a three-year, multicountry study by the Structural Adjustment Participatory Review International Network (SAPRIN), prepared in cooperation with the World Bank, national governments, and civil society organizations, offered a damning indictment of the policies of structural adjustment reform pursued by the IMF and the World Bank in third world countries. The structural adjustment programs in Greece, combined with the policies of austerity, are producing results that fit the patterns outlined in the SAPRIN study like a glove. This policy note rejects the myth of Greece as an economic success story and argues that current trends and developments in the country make for a bleak economic future. The experiment under way in Greece will produce an economy resembling, not the Celtic Tiger of the mid-1990s to early 2000s, as the current government envisions, but an underdeveloped Latin America country of the 1980s.Download:Associated Program:Author(s):C. J. Polychroniou -

Is the Link between Output and Jobs Broken?

Strategic Analysis, March 2013 | March 2013

As this report goes to press, the official unemployment rate remains tragically elevated, compared even to rates at similar points in previous recoveries. The US economy seems once again to be in a “jobless recovery,” though the unemployment rate has been steadily declining for years. At the same time, fiscal austerity has arrived, with the implementation of the sequester cuts, following tax increases and the ending of emergency extended unemployment benefits just two months ago.

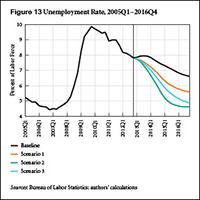

Our new report provides medium-term projections of employment and economic growth under four different scenarios. The baseline scenario starts by assuming the same growth rates and government deficits as the Congressional Budget Office’s (CBO) baseline projection from earlier this year. The result is a new surge of the unemployment rate to nearly 8 percent in the third quarter of this year, followed by a very gradual new recovery. Scenarios 1 and 2 seek to reach unemployment-rate goals of 6.5 percent and 5.5 percent, respectively, by the end of next year, using new fiscal stimulus.

We find in these simulations that reaching the goals requires large amounts of fiscal stimulus, compared to the CBO baseline. For example, in order to reach 5.5 percent unemployment in 2014, scenario 2 assumes 11 percent growth in inflation-adjusted government spending and transfers, along with lower taxes.

As an alternative, scenario 3 adds an extra increase to growth abroad and to private borrowing, along with the same amount of fiscal stimulus as in scenario 1. In this last scenario of the report, the unemployment rate finally pierces the 5.5 percent threshold from the previous scenario in the third quarter of 2015. We conclude with some thoughts about how such an increase in demand from all three sectors—government, private, and external—might be realistically obtained.

Download:Associated Program:Author(s): -

Greece: Caught Fast in the Troika's Austerity Trap

Policy Note 2012/12 | December 2012On November 27, 2012, the Eurogroup reached a new “Greek deal” that once more discloses that there is no political will to address Greece’s debt crisis—or the country’s economic and social catastrophe.

-

Fiscal Traps and Macro Policy after the Eurozone Crisis

Public Policy Brief No. 127, 2012 | November 2012The United States must make a fundamental choice in its economic policy in the next few months, a choice that will shape the US economy for years to come. Pundits and policymakers are divided over how to address what is widely referred to as the “fiscal cliff,” a combination of tax increases and spending cuts that will further weaken the domestic economy. Will the United States continue its current, misguided, policy of implementing European-style austerity measures, and the economic contraction that is the inevitable consequence of such policies? Or will it turn aside from the fiscal cliff, using a combination of its sovereign currency system and Keynesian fiscal policy to strengthen aggregate demand?

Our analysis presents a model of what we call the “fiscal trap”—a self-imposed spiral of economic contraction resulting from a fundamental misunderstanding of the role and function of fiscal policy in times of economic weakness. Within this framework, we begin our analysis with the disastrous results of austerity policies in the European Union (EU) and the UK. Our account of these policies and their results is meant as a cautionary tale for the United States, not as a model.

Download:Associated Program:Author(s): -

A Brief Guide to the US Stimulus and Austerity Debates

One-Pager No. 35 | October 2012Should we allow the fiscal cliff, with its across-the-board spending cuts and big tax increases that will affect almost every American, to take effect? Economists have been weighing in on such fiscal policy questions in what seems to be the most intense election-year debate in many years. To help our readers keep track of this debate, we offer a list of some of the specious arguments against fiscal stimulus and for austerity, together with our responses. -

Baltic Austerity—the New False Hope

One-Pager No. 32 | June 2012Ireland was at one time the poster child for fiscal austerity, but that country’s disappointing economic performance of late has left austerity apologists searching for a new model—and the Baltic economies appear to be next in line. But Estonia, Latvia, and Lithuania are as unsuited to stand as successful models of expansionary fiscal contraction and “internal devaluation” as their Irish predecessor.

Download:Associated Program:Author(s):Rainer Kattel Ringa Raudla -

Austerity that Never Was?

Policy Note 2012/5 | June 2012The Baltic States and the Crisis

The commonly cited example of the successful application of “internal” devaluation as a strategy for economic recovery is that of the Baltic economies. In this Policy Note, we discuss whether the Baltic austerity plan worked, how it was designed to work—and, most important, whether it can be replicated anywhere else. We argue that the Baltic recovery has unique features that do not relate to domestic austerity policies, nor are they replicable elsewhere.

Download:Associated Program:Author(s):Rainer Kattel Ringa Raudla -

The Mediterranean Conundrum

Public Policy Brief No. 124, 2012 | May 2012The Link between the State and the Macroeconomy, and the Disastrous Effects of the European Policy of Austerity

Conventional wisdom has calcified around the belief that the countries in the eurozone periphery are in trouble primarily because of their governments’ allegedly profligate ways. For most of these nations, however, the facts suggest otherwise. Apart from the case of Greece, the outbreak of the eurozone crisis largely preceded dramatic increases in public debt ratios, and as has been emphasized in previous Levy Institute publications, the roots of the crisis lie far more in the flawed design of the European Monetary Union and the imbalances it has generated.

But as Research Associate and Policy Fellow C. J. Polychroniou demonstrates in this policy brief, domestic political developments should not be written out of the recent history of the eurozone’s stumbles toward crisis and possible dissolution. However, the part in this tale played by southern European political regimes is quite the opposite of that which is commonly claimed or implied in the press. Instead of out-of-control, overly generous progressive agendas, the countries at the core of the crisis in southern Europe—Greece, Spain, and Portugal—have seen their macroeconomic environments shaped by the dominance of regressive political regimes and an embrace of neoliberal policies; an embrace, says Polychroniou, that helped contribute to the unenviable position their economies find themselves in today.

Download:Associated Program:Author(s):C. J. Polychroniou -

Is an Austerity-induced Depression about to Bring Down the Final Curtain on the Greek Drama?

One-Pager No. 31 | May 2012On June 17, Greece will hold a second round of elections, the outcome of which might force the European Union to halt all financial assistance to the debt-strapped country. What Greece desperately needs is a leadership with the ability to explore all possible options and to prepare the nation for the tough challenges that may lie ahead—and to make them aware of the opportunities available to a government in charge of its own currency.

Download:Associated Program:Author(s):C. J. Polychroniou -

The Euro Debt Crisis and Germany’s Euro Trilemma

Working Paper No. 721 | May 2012This paper investigates the causes behind the euro debt crisis, particularly Germany’s role in it. It is argued that the crisis is not primarily a “sovereign debt crisis” but rather a (twin) banking and balance of payments crisis. Intra-area competitiveness and current account imbalances, and the corresponding debt flows that such imbalances give rise to, are at the heart of the matter, and they ultimately go back to competitive wage deflation on Germany’s part since the late 1990s. Germany broke the golden rule of a monetary union: commitment to a common inflation rate. As a result, the country faces a trilemma of its own making and must make a critical choice, since it cannot have it all —perpetual export surpluses, a no transfer / no bailout monetary union, and a “clean,” independent central bank. Misdiagnosis and the wrongly prescribed medication of austerity have made the situation worse by adding a growth crisis to the potpourri of internal stresses that threaten the euro’s survival. The crisis in Euroland poses a global “too big to fail” threat, and presents a moral hazard of perhaps unprecedented scale to the global community.

Download:Associated Program:Author(s): -

Greece’s Pyrrhic Victories Over the Bond Swap and New Bailout

One-Pager No. 28 | March 2012Nearly two years after becoming the first eurozone member-state to be bailed out by the European Union (EU) and International Monetary Fund (IMF), Greece is officially bankrupt. True, there was never any doubt about the outcome, but Greece’s restructuring of nearly 200 billion euros in private debt and the agreement for a new bailout package signify something much bigger—namely, the formal conversion of a sovereign nation into an EU/IMF zombie debtor, and a doomsday scenario that includes its forced exit from the eurozone.

Download:Associated Program:Author(s):C. J. Polychroniou -

Neo-Hooverian Policies Threaten to Turn Europe into an Economic Wasteland

Policy Note 2012/1 | March 2012We live in a terrifying world of policymaking—an age of free-market dogmatism where the economic ideology is fundamentally flawed. Europe’s political leadership has applied neo-Hooverian (scorched-earth) policies that are shrinking economies and producing social misery as a result of massive unemployment.

Large-scale government intervention is critical in reviving an economy, but the current public-policy mania, which imposes fiscal tightening in the midst of recession, can only lead to catastrophic failure. The bailouts, for example, do not solve Greece’s debt crisis but simply postpone an official default. What is needed is a political and economic revolution that includes a return to Keynesian measures and a new institutional architecture—a United States of Europe.

Download:Associated Program:Author(s):C. J. Polychroniou -

EU’s Anorexic Mindset Drives the Region’s Economies into Depression

One-Pager No. 27 | February 2012The coordinated contractionary policy on the part of the European Union is inspired by its belief that this is the most effective way to tackle the eurozone’s “debt crisis.” However, by ignoring the endemic problems of unemployment, poverty, and homelessness—all of which have as their underlying cause the contraction of economic activity—European economic policy reveals a growing gap with the real world.

Download:Associated Program:Author(s):C. J. Polychroniou -

The New European Economic Dogma

One-Pager No. 26 | February 2012Improving Competitiveness by Reducing Living Standards and Increasing Poverty

Greece’s new EU/IMF bailout package is all about private sector wage cuts and an overhaul of labor rights. In short, it will do absolutely nothing to address the nation’s economic crisis because it is not designed to rescue Greece’s embattled economy. In fact, it will have the unwanted effect of keeping the nation locked in a vicious cycle of debt—and leading, finally, to its exit from the eurozone.Download:Associated Program:Author(s):C. J. Polychroniou -

Put an End to the Farce That’s Turned Into a Tragedy

One-Pager No. 25 | February 2012The 2007–08 global financial crisis was the second most disastrous global economic event of the last 80 years. Thanks to severe austerity measures and a fanatical commitment to fiscal consolidation, Europe’s overall economy is now close to stagnation and extremely high levels of unemployment prevail in many countries, especially in the eurozone periphery. In Greece, the situation is completely out of control, with the standard of living rapidly declining to 1960s levels and the number of unemployed having reached one in five. The second bailout plan will do nothing more than buy extra time for the European Union to build firewalls to prevent the spread of Greek contagion—and prepare the ground for Greece’s exit from the euro.Download:Associated Program:Author(s):C. J. Polychroniou -

Is the Recovery Sustainable?

Strategic Analysis, December 2011 | December 2011Fiscal austerity is now a worldwide phenomenon, and the global growth slowdown is highly unfavorable for policymakers at the national level. According to our Macro Modeling Team's baseline forecast, fears of prolonged stagnation and a moribund employment market are well justified. Assuming no change in the value of the dollar or interest rates, and deficit levels consistent with the Congressional Budget Office’s most recent “no-change” scenario, growth will remain very weak through 2016 and unemployment will exceed 9 percent.

In an alternate scenario, the authors simulate the effect of new austerity measures that are commensurate with the implementation of large federal budget cuts. Here, growth falls to 0.06 percent in the second quarter of 2014 before leveling off at approximately 1 percent and unemployment rises to 10.7 percent by the end of 2016. In their fiscal stimulus scenario, real GDP growth increases very quickly, unemployment declines to 7.2 percent, and the US current account balance reaches 1.9 percent by the end of 2016—with a debt-to-GDP ratio that, at 97.4 percent, is only slightly higher than in the baseline scenario.

An export-led growth strategy may accomplish little more than drawing a small number of scarce customers away from other exporting nations, and the authors expect no net contribution to aggregate demand growth from the financial sector. A further fiscal stimulus is clearly in order, they say, but an ill-timed round of fiscal austerity could result in a perilous situation for Washington.

Download:Associated Program:Author(s): -

Toward a Workable Solution for the Eurozone

Policy Note 2011/6 | November 2011Although it didn't originate with an economist, the malaprop “It’s déjà vu all over again” is invariably what springs to mind in the aftermath of virtually any euro summit of the past few years, all of which seem to end with the requisite promise of a so-called “final solution” to the problems posed by the increasingly problematic currency union. But it’s hard to get excited about any of the “solutions” on offer, since they steadfastly refuse to acknowledge that the eurozone’s problem is fundamentally one of flawed financial architecture. Today’s crisis has arisen because the creation of the euro has robbed nations of their sovereign ability to engage in a fiscal counterresponse against sudden external demand shocks of the kind we experienced in 2008. And it is being exacerbated by the ongoing reluctance of the European Union, European Central Bank, and International Monetary Fund—the “troika”—to abandon fiscal austerity as a quid pro quo for backstopping these nations’ bonds.

Download:Associated Programs:Author(s): -

Debtors’ Crisis or Creditors’ Crisis?

Public Policy Brief No. 121, 2011 | November 2011Who Pays for the European Sovereign and Subprime Mortgage Losses?

In the context of the eurozone’s sovereign debt crisis and the US subprime mortgage crisis, Senior Scholar Jan Kregel looks at the question of how we ought to distribute losses between borrowers and lenders in cases of debt resolution. Kregel tackles a prominent approach to this question that is grounded in an analysis of individual action and behavioral characteristics, an approach that tends toward the conclusion that the borrower should be responsible for making creditors whole. The presumption behind this style of analysis is that the borrower—the purportedly deceitful subprime mortgagee or supposedly profligate Greek—is the cause of the loss, and therefore should bear the entire burden.

Download:Associated Program:Author(s):Jan Kregel -

Greece in the Aftermath of the Debt Haircut

One-Pager No. 17 | November 2011More Austerity, a Deeper Slump, and the Surrender of National Sovereignty

It is a well-recognized fact that the Greek economy has been going from bad to worse since the first bailout in May 2010, and a leaked document relating to the bailout talks ahead of last week’s EU summit openly admitted that the policy of expansionary fiscal consolidation had been a blatant failure. So why did it take the EU leadership almost two years to recognize the need for a significant haircut on Greek debt?

Download:Associated Program:Author(s):C. J. Polychroniou -

An Unblinking Glance at a National Catastrophe and the Potential Dissolution of the Eurozone

Working Paper No. 688 | September 2011Greece’s Debt Crisis in Context

According to author and journalist C. J. Polychroniou, Greece was unfit to join the euro: its entry was orchestrated by fabricating the true state of the country’s fiscal condition, and its subsequent “growth performance” rested upon heavy state borrowing and European Union (EU) transfers. Moreover, the Greek economic crisis is also a political and moral crisis, as financial scandals and corruption have been major sources of wealth creation.

The EU and International Monetary Fund bailout plan (May 2010), which includes a structural adjustment program with harsh austerity measures, has been a social and economic catastrophe. Such policy ensures that Greece will default and be forced to exit the euro, says Polychroniou, but compelling Greek citizens to take charge of their own economic problems and national faults may be the best scenario. Extreme EU neoliberal policies also increase the risk of the eurozone’s dissolution.

Download:Associated Program:Author(s):C. J. Polychroniou -

A New “Teachable” Moment?

Policy Note 2010/4 | November 2010A common refrain heard from those trying to justify the results of the recent midterm elections is that the government’s fiscal stimulus to save the US economy from depression undermined growth, and that fiscal restraint is the key to economic expansion. Research Associate Marshall Auerback maintains that this refrain stems from a failure to understand a fundamental reality of bookkeeping—that when the government runs a surplus (deficit), the nongovernment sector runs a deficit (surplus). If the new GOP Congress led by Republicans and their Tea Party allies cuts government spending now, deficits will go higher, as growth slows, automatic stabilizers kick in, and tax revenues fall farther. And if extending the Bush tax cuts faces congressional gridlock, taxes will rise in 2011, further draining aggregate demand. Moreover, there are potential solvency issues for the United States if the debt ceiling is reached and Congress does not raise it. This chain of events potentially creates a new financial crisis and effectively forces the US government to default on its debt. The question is whether or not President Obama (and his economic advisers) will be enlightened enough to embrace this “teachable moment” about US main sector balances. Recent remarks to the press about deficit reduction suggest otherwise.

Download:Associated Programs:Author(s):