Research Topics

Publications on Fiscal policy

-

The Causes of Pandemic Inflation

One-Pager No. 70 | December 2022While the trigger for the Covid recession was unusual—a collapse of the supply side that produced a drop in demand—the inflation the US economy is now facing is not atypical, according to L. Randall Wray. In this one-pager, he explores the causes of the current inflationary environment, arguing that continuing inflation pressures come mostly from the supply side.

Wray warns that, given federal spending had already been declining substantially before the Fed started raising interest rates, rate hikes make a recession—and potentially stagflation—even more likely. A key part of our fiscal policy response should be focused on well-designed public investment addressing the substantial supply constraints still affecting the US economy—constraints that are not just due to the Covid crisis, but also decades of underinvestment in infrastructure. Such an approach, in Wray's view, would reduce inflationary pressures while supporting growth.

Download:Associated Programs:The State of the US and World Economies Monetary Policy and Financial Structure Federal Budget PolicyAuthor(s): -

Seven Replies to the Critiques of Modern Money Theory

Working Paper No. 996 | December 2021Modern Money Theory (MMT) has generated considerable scrutiny and discussions over the past decade. While it has gained some acceptance in the financial sector and among some politicians, it has come under strong criticisms from all sides of the academic spectrum and from conservative political circles. MMT has been argued to be both fascist and communist, orthodox and heterodox, dangerous and benign, unworkable and obvious, and unrealistic and clearly nothing new. The contradictory aspects of the range of criticisms suggest that there is at best a superficial understanding of the MMT framework. MMT relies on a well-established theoretical framework and is not inherently about changing the economic system; it is about changing the policymaking praxis to implement a given public purpose. That public purpose can be small or large and can be conservative or progressive; it ought not to be narrowly determined but rather should be set as democratically as possible. While MMT proponents tend to favor a public purpose that deals with what they see as major drawbacks of capitalist economies (persistent nonfrictional unemployment, unfair inequalities, and financial instability), their policy proposals do not lead to a major shift of domestic resources to the public purpose. If a major increase in government spending is implemented, MMT provides some guidance on how to do that in the least disruptive manner by drawing on past economic experiences. The point is to implement the public purpose at a pace that recognizes the potential constraint that comes from domestic resource availability and potential inflationary pressures from bottlenecks, rising import prices, and exchange rate depreciation, among others. In most cases, economies have more flexibility than what is admitted. In all cases, when monetary sovereignty prevails, the fiscal position and the public debt are poor metrics for judging the viability of a public purpose and its pace of implementation.

As such, applying MMT to policymaking does not mean that a government ought to be encouraged to record fiscal deficits or that the relation between the central bank and the treasury ought to be radically changed to allow direct financing. The fiscal balance is not a proper policy goal because it leads to irrelevant or incorrect policymaking and because it is largely outside the control of policymakers. The financial praxis of monetarily sovereign governments already conforms to MMT. Central banks and treasuries routinely coordinate their financial operations. Some governments have allowed direct financing of the treasury by the central bank; others have not but have developed equivalent ways to coordinate their fiscal and monetary operations that work around existing political constraints. Such routine coordination ensures an elastic financing of government operations that at least deals with domestic resources and is not intrinsically inflationary.Download:Associated Programs:Author(s): -

What Is MMT’s State of Play in Washington?

e-pamphlet, August 2021 | August 2021Modern Money Theory (MMT) has been frequently mentioned in recent media—first as “crazy talk” that if followed would bankrupt the nation and then, after the COVID-19 pandemic hit, as a way to finance an emergency response. In recent months, however, Washington seems to have returned to the old view that government spending must be “paid for” with new taxes. This raises the question: Has MMT really made headway with policymakers? This e-pamphlet examines the extraordinary interview given recently by Representative John Yarmuth’s (D, KY-03), Chair of the House Budget Committee, in which he explicitly adopts an MMT approach to budgeting. Chairman Yarmuth also lays out a path for realizing the major elements of President Biden’s proposals. Finally, Wray summarizes a recent presentation he gave to the Congressional Budget Office’s Macroeconomic Analysis section that urged reconsideration of the way that fiscal policy impacts are assessed.Download:Associated Programs:Monetary Policy and Financial Structure Economic Policy for the 21st Century The State of the US and World EconomiesAuthor(s): -

Keynes’s Theories of the Business Cycle

Working Paper No. 986 | March 2021Evolution and Contemporary Relevance

This paper traces the evolution of John Maynard Keynes’s theory of the business cycle from his early writings in 1913 to his policy prescriptions for the control of fluctuations in the early 1940s. The paper identifies six different “theories” of business fluctuations. With different theoretical frameworks in a 30-year span, the driver of fluctuations—namely cyclical changes in expectations about future returns—remained substantially the same. The banking system also played a pivotal role throughout the different versions, by financing and influencing the behavior of return expectations. There are four major changes in the evolution of Keynes’s business cycle theories: a) the saving–investment framework to understand changes in economic fluctuations; b) the capabilities of the banking system to moderate the business cycle; c) the effectiveness of monetary policy to fine tune the business cycle through the control of the short-term interest rate or credit conditions; and d) the role of a comprehensive fiscal policy and investment policy to attenuate fluctuations. Finally, some conclusions are drawn about the present relevance of the policy mix Keynes promoted for ensuring macroeconomic stability.Download:Associated Programs:Author(s):Pablo Gabriel Bortz -

Budget Credibility of Subnational Governments

Working Paper No. 964 | July 2020Analyzing the Fiscal Forecasting Errors of 28 States in India

Budget credibility, or the ability of governments to accurately forecast macro-fiscal variables, is crucial for effective public finance management. Fiscal marksmanship analysis captures the extent of errors in the budgetary forecasting. The fiscal rules can determine fiscal marksmanship, as effective fiscal consolidation procedures affect the fiscal behavior of the states in conducting the budgetary forecasts. Against this backdrop, applying Theil’s technique, we analyze the fiscal forecasting errors for 28 states (except Telangana) in India for the period 2011–16. There is a heterogeneity in the magnitude of errors across subnational governments in India. The forecast errors in revenue receipts have been greater than revenue expenditure. Within revenue receipts, the errors are more significantly pronounced in the grants component. Within expenditure budgets, the errors in capital spending are found to be greater than revenue spending in all the states. Partitioning the sources of errors, we identified that the errors were more broadly random than due to systematic bias, except for a few crucial macro-fiscal variables where improving the forecasting techniques can provide better estimates.Download:Associated Programs:Author(s): -

Debt Management and the Fiscal Balance

Policy Note 2020/5 | July 2020In this policy note, Jan Toporowski provides an analysis of government debt management using fiscal principles derived from the work of Michał Kalecki. Dividing the government’s budget into a “functional” and “financial” budget, Toporowski demonstrates how a financial budget balance—servicing government debt from taxes on wealth and profits that do not affect incomes and expenditures in the economy—allows a government to manage its debts without compromising the macroeconomic goals set in the functional budget. By splitting the budget into a functional budget that affects the real economy and a financial budget that just maintains debt payments and the liquidity of the financial system, the government can have two independent instruments that can be used to target, respectively, the macroeconomy and government debt—overcoming a dilemma that makes fiscal policy ineffective. This analysis also explains how pursuit of supply-side policies that result in a financial budget deficit and functional budget surplus can lead to slow growth, rising government debt, and financial instability.Download:Associated Programs:Author(s):Jan Toporowski -

Fiscal Policy in Argentina, Brazil, and Mexico and the 2030 Agenda for Sustainable Development

Working Paper No. 960 | July 2020Fiscal policy is useful as a government instrument for supporting the economy, contributing to an increase in employment, and reducing inequality through more egalitarian income distribution. Over the past 30 years, developing countries have failed to increase their real wages due to the lack of domestic value-added in the era of globalization, where global supply chains are the driving factor for attracting foreign direct investment. Under such circumstances, the role of fiscal policy has become an important factor in creating the necessary conditions for boosting the economy. With the end of commodity-export-led growth, Mexico experienced a moderate reduction of 5 percent in poverty between 2014 and 2018 due to the structural adjustment of social policies and its economic and trade relationship with the United States; during the same period there has been no change in poverty in Argentina, and Brazil has suffered a rise in poverty. Following the global financial crisis, greater attention has been paid to fiscal policy in developed and developing countries—specifically Argentina, Brazil, and Mexico (ABM)—in order to attain macroeconomic stability. One of the consequences of the financial crisis is rising income inequality and its negative effects on economic growth. Over the past decade, fiscal policy has been adopted for the economic recovery. However, the recovery has been accompanied by a decrease in real wages of the middle class. The purpose of the present research is to critically examine the results of fiscal policy in ABM and the United Nations’ 2030 Agenda for Sustainable Development.Download:Associated Programs:Author(s):Bendreff Desilus -

Greece: In Search of Investors

Strategic Analysis, January 2020 | January 20202019 marked the third year of the continuing economic recovery in Greece, with real GDP and employment rising, albeit at modest rates. In this Strategic Analysis we note that the expansion has mainly been driven by net exports, with tourism playing a dominant role. However, household consumption and investment are still too far below their precrisis levels, and a stronger and sustainable recovery should target these components of domestic demand as well.

Fiscal austerity imposed on the Greek government has achieved its target in terms of public finances, such that some fiscal space is now available to stimulate the economy. Our simulations for the 2019–21 period show that under current conditions the economy is likely to continue on a path of modest growth, and that the amount of private investment needed for a stronger recovery is unlikely to materialize.Download:Associated Program:Author(s): -

Statement of Senior Scholar L. Randall Wray to the House Budget Committee, US House of Representatives

Testimony, November 20, 2019 | November 2019Reexamining the Economic Costs of Debt

On November 20, 2019, Senior Scholar L. Randall Wray testified before the House Committee on the Budget on the topic of reexamining the economic costs of debt:

"In recent months a new approach to national government budgets, deficits, and debts—Modern Money Theory (MMT)—has been the subject of discussion and controversy. [. . .]

In this testimony I do not want to rehash the theoretical foundations of MMT. Instead I will highlight empirical facts with the goal of explaining the causes and consequences of the intransigent federal budget deficits and the growing national government debt. I hope that developing an understanding of the dynamics involved will make the topic of deficits and debt less daunting. I will conclude by summarizing the MMT views on this topic, hoping to set the record straight."

Update 1/7/2020: In an appendix, L. Randall Wray responds to a Question for the Record submitted by Rep. Ilhan OmarDownload:Associated Programs:Author(s): -

Indian Fiscal Federalism at the Crossroads

Working Paper No. 937 | October 2019Some Reflections

There is a growing recognition that fundamental changes are happening in Indian fiscal federalism ex post the abolition of the Planning Commission, the creation of the National Institution for Transforming India (NITI) Aayog, the constitutional amendment to introduce the Goods and Services Tax (GST), the establishment of the GST Council, and the historically high tax devolution to the states based on the 14th Finance Commission’s recommendations. Recently, policymakers and experts have raised a few issues, including: whether or not to make Finance Commissions “permanent” or to abolish them by making the tax devolution share constant through a constitutional amendment; the need for an institution to redress spatial inequalities in order to fill the vacuum created by abolishing the Planning Commission; and making the case for Article 282 of the constitution to be circumscribed. The debates are also focused on whether there is a need to establish a link between the GST Council and Finance Commissions, and if India should devise a mechanism of transfer that is predominantly based on sharing of grants for equalization of services rather than tax sharing. Creating a plausible framework for debt-deficit dynamics while keeping the fiscal autonomy of states intact and ensuring output gap reduction and public investment at the subnational level without creating disequilibrium were also other matters of concern. These debates are significant, especially when a group of states came together for the first time ever to question the terms of reference of the 15th Finance Commission amid growing tensions in federal-state relations in India. -

Challenges to Indian Fiscal Federalism

Book Series, October 2019 | October 2019 The principle of fiscal federalism enshrined in India's Constitution is under severe strain today. This book is a key addition to understanding the challenges involved. The authors capture the implications of the abolition of the Planning Commission, the introduction of the controversial Goods and Services Tax regime, and formulation of Terms of Reference of the 15th Finance Commission. These include the increase in vertical fiscal inequity, distortion of fairness in inter-State distribution, and erosion of policy autonomy at the level of the States.

The principle of fiscal federalism enshrined in India's Constitution is under severe strain today. This book is a key addition to understanding the challenges involved. The authors capture the implications of the abolition of the Planning Commission, the introduction of the controversial Goods and Services Tax regime, and formulation of Terms of Reference of the 15th Finance Commission. These include the increase in vertical fiscal inequity, distortion of fairness in inter-State distribution, and erosion of policy autonomy at the level of the States.

Published by: Leftword PressAssociated Program: -

Rethinking China’s Local Government Debt in the Frame of Modern Money Theory

Working Paper No. 932 | June 2019Local government debt in China is increasing and presents a great threat to China’s financial stability. In China’s fiscal system, the central government often prioritizes reducing its fiscal deficit and can determine to a great extent the distribution of revenue and expenditure between itself and local governments. There is therefore a tendency for the fiscal burden to be shifted from the central government to the local governments. Resolving China’s local government debt problem requires not only strengthening regulation, but also abandoning the central government’s fiscal balance target, because this target may make regulation hard to sustain in times of economic downturn. This paper discusses central-local fiscal relations in the framework of Modern Money Theory, suggesting that, because a government with currency sovereignty can always afford any spending denominated in its own currency, China’s central government should bear a greater fiscal burden.Download:Associated Program:Author(s):Zengping He Genliang Jia -

Fiscal Stabilization in the United States

Working Paper No. 926 | April 2019Lessons for Monetary Unions

The debate about the use of fiscal instruments for macroeconomic stabilization has regained prominence in the aftermath of the Great Recession, and the experience of a monetary union equipped with fiscal shock absorbers, such as the United States, has often been a reference. This paper enhances our knowledge about the degree of macroeconomic stabilization achieved in the United States through the federal budget, providing a detailed breakdown of the different channels. In particular, we investigate the relative importance and stabilization impact of the federal system of unemployment benefits and of its extension as a response to the Great Recession. The analysis shows that in the United States, corporate income taxes collected at the federal level are the single most efficient instrument for providing stabilization, given that even with a smaller size than other instruments they can provide important effects, mainly against common shocks. On the other hand, Social Security benefits and personal income taxes have a greater role in stabilizing asymmetric shocks. A federal system of unemployment insurance, then, can play an important stabilization role, in particular when enhanced by a discretionary program of extended benefits in the event of a large shock, like the Great Recession.Download:Associated Programs:Author(s):Plamen Nikolov Paolo Pasimeni -

Can Redistribution Help Build a More Stable Economy?

Strategic Analysis, April 2019 | April 2019Although the ongoing recovery is about to become the longest in the history of the United States, it is also the weakest in postwar history, and as we enter the second quarter of 2019, many clouds have gathered.

This Strategic Analysis considers the recent trajectory, the present state, and the future prospects of the US economy. The authors identify four main structural problems that explain how we arrived at the crisis of 2007–09 and why the recovery that has followed has been so weak—as well as why the prospect of a recession is increasingly likely.

The US economy is in need of deep structural reforms that will deal with these problems. This report analyzes a pair of policies that begin to move in that direction, both involving an increase in the tax rate for high-income and high-net-worth households. Even if the primary justification for these policies is not economic, this report shows that if such an increase in taxes is accompanied by an equivalent increase in government outlays, the redistributive impact will have a positive macroeconomic effect while moving the US economy toward a more sustainable future.Download:Associated Program:Author(s): -

Macroeconomic Policy Effectiveness and Inequality

Working Paper No. 920 | January 2019Efficacy of Gender Budgeting in Asia Pacific

Gender budgeting is a fiscal approach that seeks to use a country’s national and/or local budget(s) to reduce inequality and promote economic growth and equitable development. While the literature has explored the connection between reducing gender inequality and achieving growth and equitable development, more empirical analysis is needed on whether gender budgeting reduces gender inequality. Our study follows the methodology of Stotsky and Zaman (2016) to investigate the impact of gender budgeting on promoting gender equality across Asia Pacific countries. The study classifies Asia Pacific countries as gender budgeting or non-gender budgeting according to whether they have formalized gender budgeting initiatives in laws and/or budget call circulars. To measure the effect of gender budgeting on reducing inequality, we measure the correlation between gender budgeting and the Gender Development Index (GDI) and the Gender Inequality Index (GII) scores in each country. The data for our gender inequality variables are mainly drawn from the IMF database on gender indicators and the World Development Indicators database over the 1990–2013 period. Our results show that gender budgeting has a significant effect on increasing the GDI and a small but significant potential to reduce the GII, strengthening the rationale for employing gender budgeting to promote inclusive development. However, our empirical results show no prioritization of gender budgeting in the fiscal space of health and education sectors in the region.Download:Associated Program:Author(s): -

Two Harvard Economists on Monetary Economics

Working Paper No. 917 | October 2018Lauchlin Currie and Hyman Minsky on Financial Systems and Crises

In November 1987, Hyman Minsky visited Bogotá, Colombia, after being invited by a group of professors who at that time were interested in post-Keynesian economics. There, Minsky delivered some lectures, and Lauchlin Currie attended two of those lectures at the National University of Colombia. Although Currie is not as well-known as Minsky in the American academy, both are outstanding figures in the development of non-orthodox approaches to monetary economics. Both alumni of the economics Ph.D. program at Harvard had a debate in Bogotá. Unfortunately, there are no formal records of this, so here a question arises: What could have been their respective positions? The aim of this paper is to discuss Currie’s and Minsky’s perspectives on monetary economics and to speculate on what might have been said during their debate.Download:Associated Program:Author(s):Iván D. Velasquez -

Unconventional Monetary Policies and Central Bank Profits

Working Paper No. 916 | October 2018Seigniorage as Fiscal Revenue in the Aftermath of the Global Financial Crisis

This study investigates the evolution of central bank profits as fiscal revenue (or: seigniorage) before and in the aftermath of the global financial crisis of 2008–9, focusing on a select group of central banks—namely the Bank of England, the United States Federal Reserve System, the Bank of Japan, the Swiss National Bank, the European Central Bank, and the Eurosystem (specifically Deutsche Bundesbank, Banca d’Italia, and Banco de España)—and the impact of experimental monetary policies on central bank profits, profit distributions, and financial buffers, and the outlook for these measures going forward as monetary policies are seeing their gradual “normalization.”

Seigniorage exposes the connections between currency issuance and public finances, and between monetary and fiscal policies. Central banks’ financial independence rests on seigniorage, and in normal times seigniorage largely derives from the note issue supplemented by “own” resources. Essentially, the central bank’s income-earning assets represent fiscal wealth, a national treasure hoard that supports its central banking functionality. This analysis sheds new light on the interdependencies between monetary and fiscal policies.

Just as the size and composition of central bank balance sheets experienced huge changes in the context of experimental monetary policies, this study’s findings also indicate significant changes regarding central banks’ profits, profit distributions, and financial buffers in the aftermath of the crisis, with considerable cross-country variation.Download:Associated Program:Author(s): -

An Alternative to Sovereign Bond-Backed Securities for the Euro Area

One-Pager No. 56 | June 2018The European Commission's proposal for the regulation of sovereign bond-backed securities (SBBSs) follows the release of a high-level taskforce report, sponsored by the European Systemic Risk Board, on the feasibility of an SBBS framework. The proposal and the SBBS scheme, Mario Tonveronachi argues, would fail to yield the intended results while undermining financial stability.

Tonveronachi articulates his alternative, centered on the European Central Bank's issuance of debt certificates along the maturity spectrum to create a common yield curve and corresponding absorption of a share of each eurozone country’s national debts. Alongside these financial operations, new reflationary but debt-reducing fiscal rules would be imposed.Download:Associated Programs:Author(s):Mario Tonveronachi -

European Sovereign Bond-Backed Securities

Public Policy Brief No. 145, 2018 | June 2018An Assessment and an Alternative Proposal

In response to a proposal put forward by the European Commission for the regulation of sovereign bond-backed securities (SBBSs), Mario Tonveronachi provides his analysis of the SBBS scheme and attendant regulatory proposal, and elaborates on an alternative approach to addressing the problems that have motivated this high-level consideration of an SBBS framework.

As this policy brief explains, it is doubtful the SBBS proposal would produce its intended results. Tonveronachi’s alternative, discussed in Levy Institute Public Policy Briefs Nos. 137 and 140, not only better addresses the two problems targeted by the SBBS scheme, but also a third, critical defect of the current euro system: national sovereign debt sustainability.Download:Associated Programs:Author(s):Mario Tonveronachi -

“America First,” Fiscal Policy, and Financial Stability

Strategic Analysis, April 2018 | April 2018The US economy has been expanding continuously for almost nine years, making the current recovery the second longest in postwar history. However, the current recovery is also the slowest recovery of the postwar period.

This Strategic Analysis presents the medium-run prospects, challenges, and contradictions for the US economy using the Levy Institute’s stock-flow consistent macroeconometric model. By comparing a baseline projection for 2018–21 in which no budget or tax changes take place to three additional scenarios, the authors isolate the likely macroeconomic impacts of: (1) the recently passed tax bill; (2) a large-scale public infrastructure plan of the same “fiscal size” as the tax cuts; and (3) the spending increases entailed by the Bipartisan Budget Act and omnibus bill. Finally, Nikiforos and Zezza update their estimates of the likely outcome of a scenario in which there is a sharp drop in the stock market that induces another round of private-sector deleveraging.

Although in the near term the US economy could see an acceleration of its GDP growth rate due to the recently approved increase in federal spending and the new tax law, it is increasingly likely that the recovery will be derailed by a crisis that will originate in the financial sector.

Download:Associated Program:Author(s): -

Corporate Tax Incidence in India

Working Paper No. 898 | October 2017The paper attempts to measure the incidence of corporate income tax in India under a general equilibrium setting. Using seemingly uncorrelated regression coefficients and dynamic panel estimates, we tried to analyze both the relative burden of corporate tax borne by capital and labor and the efficiency effects of corporate income tax. The data for the study is compiled from corporate firms listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE) for the period 2000–15. Our empirical estimates suggest that in India capital bears more of the burden of corporate taxes than labor. Though it is contrary to the Harberger (1962) hypothesis that the burden of corporate tax is shifted to labor rather than capital, it confirms the existing empirical results in the context of India. -

The Concert of Interests in the Age of Trump

Policy Note 2017/2 | July 2017If the Trump administration is to fulfill its campaign promises to this age’s “forgotten” men and women, Director of Research Jan Kregel argues, it should embrace the broader lesson of the 1930s: that government regulation and fiscal policy are crucial in addressing changes in the economic and financial structure that have exacerbated the problems faced by struggling communities.

In this policy note, Kregel explains how overcoming the economic and financial challenges we face today, just as in the 1930s, requires avoiding what Walter Lippmann identified as an “obvious error”: the blind belief that reducing regulation and the role of government will somehow restore a laissez-faire market liberalism that never existed and is inappropriate to the changing structure of production of both the US and the global economy.

Download:Associated Program:Author(s):Jan Kregel -

Inequality Update: Who Gains When Income Grows?

Policy Note 2017/1 | April 2017Since the 1980s, economic recoveries in the United States have been delivering the vast majority of income growth to the wealthiest households. This policy note updates the analysis in One-Pager No. 47 and Policy Note 2015/4 with the latest data through 2015, looking at the distribution of average income growth (with and without capital gains) between the bottom 90 percent and top 10 percent of households, and between the bottom 99 percent and top 1 percent of households.

Little has changed when considering the distribution of average income growth in the current recovery (up to 2015) between the bottom 90 percent and top 10 percent of families, with or without capital gains. Although average real income for the bottom 90 percent of households is no longer shrinking, these families still capture a historically small proportion of that growth—only between 18 percent and 22 percent. The growing economy continues to deliver the most benefits to the wealthiest families.Download:Associated Program:Author(s): -

Fiscal Policy, Economic Growth and Innovation

Working Paper No. 883 | February 2017An Empirical Analysis of G20 Countries

This paper analyzes the effectiveness of public expenditures on economic growth within the analytical framework of comprehensive Neo-Schumpeterian economics. Using a fixed-effects model for G20 countries, the paper investigates the links between the specific categories of public expenditures and economic growth, captured in human capital formation, defense, infrastructure development, and technological innovation. The results reveal that the impact of innovation-related spending on economic growth is much higher than that of the other macro variables. Data for the study was drawn from the International Monetary Fund’s Government Finance Statistics database, infrastructure reports for the G20 countries, and the World Development Indicators issued by the World Bank.

Download:Associated Programs:Author(s): -

Brazil Still in Troubled Waters

Public Policy Brief No. 143, 2017 | February 2017Since inheriting the Brazilian presidency five months ago, the new Temer administration has successfully ratified a constitutional amendment imposing a radical, two-decades-long public spending freeze, purportedly aimed at sparking an increase in business confidence and investment. In this policy brief, Fernando Cardim de Carvalho explains why this fiscal strategy is based not only on a flawed conception of the drivers of private-sector confidence and investment but also on a mistaken view of the roots of the current Brazilian economic crisis. The hoped-for “expansionary fiscal consolidation” is not likely to be achieved.

Download:Associated Program: -

The Short- and Long-run Inconsistency of the Expansionary Austerity Theory

Working Paper No. 878 | December 2016A Post-Keynesian/Evolutionist Critique

This paper provides a critical analysis of expansionary austerity theory (EAT). The focus is on the theoretical weaknesses of EAT—the extreme circumstances and fragile assumptions under which expansionary consolidations might actually take place. The paper presents a simple theoretical model that takes inspiration from both the post-Keynesian and evolutionary/institutionalist traditions. First, it demonstrates that well-designed austerity measures hardly trigger short-run economic expansions in the context of expected long-lasting consolidation plans (i.e., when adjustment plans deal with remarkably high debt-to-GDP ratios), when the so-called “financial channel” is not operative (i.e., in the context of monetarily sovereign economies), or when the degree of export responsiveness to internal devaluation is low. Even in the context of non–monetarily sovereign countries (e.g., members of the eurozone), austerity’s effectiveness crucially depends on its highly disputable capacity to immediately stabilize fiscal variables.

The paper then analyzes some possible long-run economic dynamics, emphasizing the high degree of instability that characterizes austerity-based adjustments plans. Path-dependency and cumulativeness make the short-run impulse effects of fiscal consolidation of paramount importance to (hopefully) obtaining any appreciable medium-to-long-run benefit. Should these effects be contractionary at the onset, the short-run costs of austerity measures can breed an endless spiral of recession and ballooning debt in the long run. If so, in the case of non–monetarily sovereign countries debt forgiveness may emerge as the ultimate solution to restore economic soundness. Alternatively, institutional innovations like those adopted since mid-2012 by the European Central Bank are required to stabilize the economy, even though they are unlikely to restore rapid growth in the absence of more active fiscal stimuli.

Download:Associated Programs:Author(s):Alberto Botta -

Measuring Poverty in the Case of Buenos Aires

Working Paper No. 865 | May 2016Why Time Deficits Matter

We describe the production of estimates of the Levy Institute Measure of Time and Income Poverty (LIMTIP) for Buenos Aires, Argentina, and use it to analyze the incidence of time and income poverty. We find high numbers of hidden poor—those who are not poor according to the official measure but are found to be poor when using our time-adjusted poverty line. Large time deficits for those living just above the official poverty line are the reason for this hidden poverty. Time deficits are unevenly distributed by employment status, family type, and especially gender. Simulations of the impact of full-time employment on those households with nonworking (for pay) adults indicate that reductions in income poverty can be achieved, but at the cost of increased time poverty. Policy interventions that address the lack of both income and time are discussed.

Download:Associated Programs:The Distribution of Income and Wealth Gender Equality and the Economy The Levy Institute Measure of Time and Income Poverty Hewlett Foundation�Levy Institute ProjectAuthor(s): -

The Narrow Path for Brazil

Policy Note 2016/2 | April 2016Brazil is mired in a joint economic and political crisis, and the way out is unclear. In 2015 the country experienced a steep contraction of output alongside elevated inflation, all while the fallout from a series of corruption scandals left the policymaking apparatus paralyzed. Looking ahead, implementing a policy strategy that has any hope of addressing the Brazilian economy’s multilayered problems would make serious demands on a political system that is most likely unable to bear it.

-

What We Could Have Learned from the New Deal in Confronting the Recent Global Recession

Public Policy Brief No. 141, 2016 | March 2016To the extent that policymakers have learned anything at all from the Great Depression and the policy responses of the 1930s, the lessons appear to have been the wrong ones. In this public policy brief, Director of Research Jan Kregel explains why there is still a great deal we have to learn from the New Deal. He illuminates one of the New Deal’s principal objectives—quelling the fear and uncertainty of mass unemployment—and the pragmatic, experimental process through which the tool for achieving this objective—directed government expenditure—came to be embraced.

In the search for a blueprint from the 1930s, Kregel suggests that too much attention has been paid to the measures deployed to shore up the banking system, and that the approaches underlying the emergency financial policy measures of the recent period and those of the 1930s were actually quite similar. The more meaningful divergence between the 1930s and the post-2008 policy response, he argues, can be uncovered by comparing the actions that were taken (or not taken, as the case may be) to address the real sector of the economy following the resolution of the respective financial crises.Download:Associated Program:Author(s):Jan Kregel -

Completing the Single Financial Market and New Fiscal Rules for the Euro Area

One-Pager No. 51 | December 2015Until market participants across the euro area face a single risk-free yield curve rather than a diverse collection of quasi-risk-free sovereign rates, financial market integration will not be complete. Unfortunately, the institution that would normally provide the requisite benchmark asset—a federal treasury issuing risk-free debt—does not exist in the euro area, and there are daunting political obstacles to creating such an institution.

There is, however, another way forward. The financial instrument that could provide the foundation for a single market already exists on the balance sheet of the European Central Bank (ECB): legally, the ECB could issue “debt certificates” (DCs) across the maturity spectrum and in sufficient amounts to create a yield curve. Moreover, reforming ECB operations along these lines may hold the key to addressing another of the euro area’s critical dysfunctions. Under current conditions, the Maastricht Treaty’s fiscal rules create a vicious cycle by contributing to a deflationary economic environment, which slows the process of debt adjustment, requiring further deflationary budget tightening. By changing national debt dynamics and thereby enabling a revision of the fiscal rules, the DC proposal could short-circuit this cycle of futility.Download:Associated Programs:Author(s):Mario Tonveronachi -

Redistribution in the Age of Austerity

Working Paper No. 856 | December 2015Evidence from Europe, 2006–13

We examine the relationship between changes in a country’s public sector fiscal position and inequality at the top and bottom of the income distribution during the age of austerity (2006–13). We use a parametric Lorenz curve model and Gini-like indices of inequality as our measures to assess distributional changes. Based on the EU’s Statistics on Income and Living Conditions SLIC and International Monetary Fund data for 12 European countries, we find that more severe adjustments to the cyclically adjusted primary balance (i.e., more austerity) are associated with a more unequal distribution of income driven by rising inequality at the top. The data also weakly suggest a decrease in inequality at the bottom. The distributional impact of austerity measures reflects the reliance on regressive policies, and likely produces increased incentives for rent seeking while reducing incentives for workers to increase productivity.

Download:Associated Programs:The State of the US and World Economies The Distribution of Income and Wealth Economic Policy for the 21st CenturyAuthor(s):Markus P.A. Schneider Stephen Kinsella Antoine Godin -

The ECB, the Single Financial Market, and a Revision of the Euro Area Fiscal Rules

Public Policy Brief No. 140, 2015 | November 2015Mario Tonveronachi, University of Siena, builds on his earlier proposal (The ECB and the Single European Financial Market) to advance financial market integration in Europe through the creation of a single benchmark yield curve based on debt certificates (DCs) issued by the European Central Bank (ECB). In this policy brief, Tonveronachi discusses potential changes to the ECB’s operations and their implications for member-state fiscal rules. He argues that his DC proposal would maintain debt discipline while mitigating the restrictive, counterproductive fiscal stance required today, simultaneously expanding national fiscal space while ensuring debt sustainability under the Maastricht limits, and offering a path out of the self-defeating policy regime currently in place.

Download:Associated Programs:Author(s):Mario Tonveronachi -

Is Monetary Financing Inflationary?

Working Paper No. 848 | October 2015A Case Study of the Canadian Economy, 1935–75

Historically high levels of private and public debt coupled with already very low short-term interest rates appear to limit the options for stimulative monetary policy in many advanced economies today. One option that has not yet been considered is monetary financing by central banks to boost demand and/or relieve debt burdens. We find little empirical evidence to support the standard objection to such policies: that they will lead to uncontrollable inflation. Theoretical models of inflationary monetary financing rest upon inaccurate conceptions of the modern endogenous money creation process. This paper presents a counter-example in the activities of the Bank of Canada during the period 1935–75, when, working with the government, it engaged in significant direct or indirect monetary financing to support fiscal expansion, economic growth, and industrialization. An institutional case study of the period, complemented by a general-to-specific econometric analysis, finds no support for a relationship between monetary financing and inflation. The findings lend support to recent calls for explicit monetary financing to boost highly indebted economies and a more general rethink of the dominant New Macroeconomic Consensus policy framework that prohibits monetary financing.

Download:Associated Program:Author(s):Josh Ryan-Collins -

Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems, Second Edition

Book Series, September 2015 | September 2015By L. Randall Wray

In a completely revised second edition, Senior Scholar L. Randall Wray presents the key principles of Modern Money Theory, exploring macro accounting, monetary and fiscal policy, currency regimes, and exchange rates in developed and developing nations. Wray examines how misunderstandings about the nature of money caused the recent global financial meltdown, and provides fresh ideas about how leaders should approach economic policy. This updated edition also includes new chapters on tax policies and inflation.

Published by: Palgrave Macmillan

-

Is a Very High Public Debt a Problem?

Working Paper No. 843 | July 2015This paper has two main objectives. The first is to propose a policy architecture that can prevent a very high public debt from resulting in a high tax burden, a government default, or inflation. The second objective is to show that government deficits do not face a financing problem. After these deficits are initially financed through the net creation of base money, the private sector necessarily realizes savings, in the form of either government bond purchases or, if a default is feared, “acquisitions” of new money.

Download:Associated Program:Author(s):Pedro Leao -

Inside Money in a Kaldor-Kalecki-Steindl Fiscal Policy Model

Working Paper No. 839 | June 2015The Unit of Account, Inflation, Leverage, and Financial Fragility

We hope to model financial fragility and money in a way that captures much of what is crucial in Hyman Minsky’s financial fragility hypothesis. This approach to modeling Minsky may be unique in the formal Minskyan literature. Namely, we adopt a model in which a psychological variable we call financial prudence (P) declines over time following a financial crash, driving a cyclical buildup of leverage in household balance sheets. High leverage or a low safe-asset ratio in turn induces high financial fragility (FF). In turn, the pathways of FF and capacity utilization (u) determine the probabilistic risk of a crash in any time interval. When they occur, these crashes entail discrete downward jumps in stock prices and financial sector assets and liabilities. To the endogenous government liabilities in Hannsgen (2014), we add common stock and bank loans and deposits. In two alternative versions of the wage-price module in the model (wage–Phillips curve and chartalist, respectively), the rate of wage inflation depends on either unemployment or the wage-setting policies of the government sector. At any given time t, goods prices also depend on endogenous markup and labor productivity variables. Goods inflation affects aggregate demand through its impact on the value of assets and debts. Bank rates depend on an endogenous markup of their own. Furthermore, in light of the limited carbon budget of humankind over a 50-year horizon, goods production in this model consumes fossil fuels and generates greenhouse gases.

The government produces at a rate given by a reaction function that pulls government activity toward levels prescribed by a fiscal policy rule. Subcategories of government spending affect the pace of technical progress and prudence in lending practices. The intended ultimate purpose of the model is to examine the effects of fiscal policy reaction functions, including one with dual unemployment rate and public production targets, testing their effects on numerically computed solution pathways. Analytical results in the penultimate section show that (1) the model has no equilibrium (steady state) for reasons related to Minsky’s argument that modern capitalist economies possess a property that he called “the instability of stability,” and (2) solution pathways exist and are unique, given vectors of initial conditions and parameter values and realizations of the Poisson model of financial crises.

Download:Associated Program:Author(s): -

When a Rising Tide Sinks Most Boats

Policy Note 2015/4 | March 2015Trends in US Income Inequality

In the postwar period, with every subsequent expansion, a smaller and smaller share of the gains in income growth have gone to the bottom 90 percent of families. Worse, in the latest expansion, while the economy has grown and average real income has recovered from its 2008 lows, all of the growth has gone to the wealthiest 10 percent of families, and the income of the bottom 90 percent has fallen. Most Americans have not felt that they have been part of the expansion. We have reached a situation where a rising tide sinks most boats. This policy note provides a broader overview of the increasingly unequal distribution of income growth during expansions, examines some of the changes that occurred from 2012 to 2013, and identifies a disturbing business cycle trend. It also suggests that policy must go beyond the tax system if we are serious about reversing the drastic worsening of income inequality.Download:Associated Program:Author(s): -

Minsky, Monetary Policy, and Mint Street

Working Paper No. 820 | November 2014Challenges for the Art of Monetary Policymaking in Emerging Economies

This paper examines the emerging challenges to the art of monetary policymaking using the case study of the Reserve Bank of India (RBI) in light of developments in the Indian economy during the last decade (2003–04 to 2013–14). The paper uses Hyman P. Minsky’s financial instability hypothesis as the conceptual framework for evaluating the endogenous nature of financial instability and its potential impact on monetary policymaking, and addresses the need to pursue regulatory policy as a tool that is complementary to monetary policy in light of the agenda of reforms put forward by Minsky. It further reviews the extensions to the Minskyan hypothesis in the areas of setting fiscal policy, managing cross-border capital flows, and developing financial institutional infrastructure. The lessons learned from the interplay of policy choices in these areas and their impact on monetary policymaking at the RBI are presented.

Download:Associated Program:Author(s):Srinivas Yanamandra -

Growth for Whom?

One-Pager No. 47 | October 2014In the postwar period, income growth has become more inequitably distributed with virtually every subsequent economic expansion. From 2009 to 2012, while the economy was recovering from one of the biggest economic downturns in recent memory, the top 1 percent took home 95 percent of the income gains. To reverse this pattern, Research Associate Pavlina R. Tcherneva recommends policy strategies to promote growth from the bottom up—to change the income distribution directly by funding employment opportunities in the public, nonprofit, or social entrepreneurial sector.Download:Associated Program:Author(s): -

Will Tourism Save Greece?

Strategic Analysis, August 2014 | August 2014What are the prospects for economic recovery if Greece continues to follow the troika strategy of fiscal austerity and internal devaluation, with the aim of increasing competitiveness and thus net exports? Our latest strategic analysis indicates that the unprecedented decline in real and nominal wages may take a long time to exert its effects on trade—if at all—while the impact of lower prices on tourism will not generate sufficient revenue from abroad to meet the targets for a surplus in the current account that outweighs fiscal austerity. The bottom line: a shift in the fiscal policy stance, toward lower taxation and job creation, is urgently needed.Download:Associated Program:Author(s): -

The Euro Treasury Plan

Public Policy Brief No. 135, 2014 | August 2014Contrary to German chancellor Angela Merkel’s recent claim, the euro crisis is not nearly over but remains unresolved, leaving the eurozone extraordinarily vulnerable to renewed stresses. In fact, as the reforms agreed to so far have failed to turn the flawed and dysfunctional euro regime into a viable one, the current calm in financial markets is deceiving, and unlikely to last. The euro regime’s essential flaw and ultimate source of vulnerability is the decoupling of central bank and treasury institutions in the euro currency union. In this public policy brief, Research Associate Jörg Bibow proposes a Euro Treasury scheme to properly fix the regime and resolve the euro crisis. The Euro Treasury would establish the treasury–central bank axis of power that exists at the center of control in sovereign states. Since the eurozone is not actually a sovereign state, the proposed treasury is specifically designed not to be a transfer union; no mutualization of existing national public debts is involved either. The Euro Treasury would be the means to pool future eurozone public investment spending, funded by proper eurozone treasury securities, and benefits and contributions would be shared across the currency union based on members’ GDP shares. The Euro Treasury would not only heal the euro’s potentially fatal birth defects but also provide the needed stimulus to end the crisis in the eurozone.Download:Associated Program:Author(s): -

Economic Policy in India

Working Paper No. 813 | August 2014For Economic Stimulus, or for Austerity and Volatility?

The implementation of economic reforms under new economic policies in India was associated with a paradigmatic shift in monetary and fiscal policy. While monetary policies were solely aimed at “price stability” in the neoliberal regime, fiscal policies were characterized by the objective of maintaining “sound finance” and “austerity.” Such monetarist principles and measures have also loomed over the global recession. This paper highlights the theoretical fallacies of monetarism and analyzes the consequences of such policy measures in India, particularly during the period of the global recession. Not only did such policies pose constraints on the recovery of output and employment, with adverse impacts on income distribution; but they also failed to achieve their stated goal in terms of price stability. By citing examples from southern Europe and India, this paper concludes that such monetarist policy measures have been responsible for stagnation, with a rise in price volatility and macroeconomic instability in the midst of the global recession.

-

How Poor Is Turkey? And What Can Be Done About It?

Public Policy Brief No. 132, 2014 | May 2014Gauging the severity of poverty in a given country requires a reasonably comprehensive measurement of whether individuals and households are surpassing some basic threshold of material well-being. This would seem to be an obvious point, and yet, in most cases, our official poverty metrics fail that test, often due to a crucial omission. In this policy brief, Senior Scholar Ajit Zacharias, Research Scholar Thomas Masterson, and Research Associate Emel Memiş present an alternative measure of poverty for Turkey and lay out the policy lessons that follow. Their research reveals that the number of people living in poverty and the severity of their deprivation have been significantly underestimated. This report is part of an ongoing Levy Institute project on time poverty (the Levy Institute Measure of Time and Income Poverty), which has produced research on Latin America, Korea, and now Turkey, with the aim of extending this approach to other countries.Download:Associated Programs:Author(s): -

Time Deficits and Poverty

Research Project Report, May 2014 | May 2014The Levy Institute Measure of Time and Consumption Poverty for Turkey

Official poverty lines in Turkey and other countries often ignore the fact that unpaid household production activities that contribute to the fulfillment of material needs and wants are essential for the household to reproduce itself as a unit. This omission has consequences. Taking household production for granted when measuring poverty yields an unacceptably incomplete picture, and therefore estimates based on such an omission provide inadequate guidance to policymakers.

Standard measurements of poverty assume that all households and individuals have enough time to adequately attend to the needs of household members—including, for example, children. These tasks are absolutely necessary for attaining a minimum standard of living. But this assumption is false. For numerous reasons, some households may not have sufficient time, and they thus experience what are referred to as “time deficits.” If a household officially classified as nonpoor has a time deficit and cannot afford to cover it by buying market substitutes (e.g., hire a care provider), that household will encounter hardships not reflected in the official poverty measure. To get a more accurate calculus of poverty, we have developed the Levy Institute Measure of Time and Consumption Poverty (LIMTCP), a two-dimensional measure that takes into account both the necessary consumption expenditures and household production time needed to achieve a minimum living standard.

Download:Associated Programs:Author(s): -

Modern Money Theory and Interrelations between the Treasury and the Central Bank

Working Paper No. 788 | March 2014The Case of the United States

One of the main contributions of Modern Money Theory (MMT) has been to explain why monetarily sovereign governments have a very flexible policy space that is unconstrained by hard financial limits. Not only can they issue their own currency to pay public debt denominated in their own currency, but they can also easily bypass any self-imposed constraint on budgetary operations. Through a detailed analysis of the institutions and practices surrounding the fiscal and monetary operations of the treasury and central bank of the United States, the eurozone, and Australia, MMT has provided institutional and theoretical insights into the inner workings of economies with monetarily sovereign and nonsovereign governments. The paper shows that the previous theoretical conclusions of MMT can be illustrated by providing further evidence of the interconnectedness of the treasury and the central bank in the United States.

Download:Associated Program:Author(s): -

Wright Patman’s Proposal to Fund Government Debt at Zero Interest Rates

Policy Note 2014/2 | February 2014Lessons for the Current Debate on the US Debt Limit

In 1943, Congress faced unpredictably large war expenditures exceeding the prevailing debt limit. Congressional debates from that time contain an insightful discussion of how the increased expenditures could be financed, dealing with practical and theoretical issues that seem to be missing from current debates. In the '43 debate, Representative Wright Patman proposed that the Treasury should create a nonnegotiable zero interest bond that would be placed directly with the Federal Reserve Banks. As the deadline for raising the US federal government debt limit approaches, Senior Scholar Jan Kregel examines the implications of Patman's proposal. Among the lessons: that the debt can be financed at any rate the government desires without losing control over interest rates as a tool of monetary policy. The problem of financing the debt is not the issue. The question is whether the size of the deficit to be financed is compatible with the stable expansion of the economy.Download:Associated Program:Author(s):Jan Kregel -

The Social Enterprise Model for a Job Guarantee in the United States

Policy Note 2014/1 | January 2014The job guarantee is a proposal that provides greater macroeconomic stability and secures a fundamental human right. Despite the economic and moral merits of this policy, often the program is rejected because of concerns about its administration. How would the program be implemented? Who will create the jobs? Can work be found for every unemployed individual who wishes to work? This policy note addresses these concerns by elaborating on a proposal for the United States that would run the job guarantee through the social enterprise sector, which includes traditional nonprofit organizations and emerging nonprofit social entrepreneurial ventures.Download:Associated Program:Author(s): -

Integrating Time in Public Policy

Working Paper No. 785 | January 2014Empirical Description of Gender-specific Outcomes and Budgeting

Incorporating time in public policymaking is an elusive area of research. Despite the fact that gender budgeting is emerging as a significant tool to analyze the socioeconomic impacts of fiscal policies and thus identify their impacts on gender equity, the integration of time-use statistics in this process remains incomplete, or is even entirely absent, in most countries. If gender budgeting is predominantly based on the index-based empirical description of gender-specific outcomes, a reexamination of the construction of the gender (inequality) index is needed. This is necessary if we are to avoid an incomplete description of the gender-specific outcomes in budget policymaking. Further, “hard-to-price” services are hardly analyzed in public policymaking. This issue is all the more revealing, as the available gender-inequality index—based on health, empowerment, and labor market participation – so far has not integrated time-use statistics in its calculations. From a public finance perspective, the gender budgeting process often rests on the assumption that mainstream expenditures, such as public infrastructure, are nonrival in nature, and that applying a gender lens to these expenditures is not feasible. This argument is refuted by time budget statistics. The time budget data reveal that this argument is often flawed, as there is an intrinsic gender dimension to nonrival expenditures.

Download:Associated Program:Author(s): -

Options for China in a Dollar Standard World

Working Paper No. 783 | January 2014A Sovereign Currency Approach

This paper examines the fiscal and monetary policy options available to China as a sovereign currency-issuing nation operating in a dollar standard world. We first summarize a number of issues facing China, including the possibility of slower growth, global imbalances, and a number of domestic imbalances. We then analyze current monetary and fiscal policy formation and examine some policy recommendations that have been advanced to deal with current areas of concern. We next outline the sovereign currency approach and use it to analyze those concerns. We conclude with policy recommendations consistent with the policy space open to China.Download:Associated Programs:Author(s): -

Policy Options for China

One-Pager No. 44 | December 2013Reorienting Fiscal Policy to Reduce Financial Fragility

Since adopting a policy of gradually opening its economy more than three decades ago, China has enjoyed rapid economic growth and rising living standards for much of its population. While some argue that China might fall into the middle-income “trap,” they are underestimating the country’s ability to continue to grow at a rapid pace. It is likely that China’s growth will eventually slow, but the nation will continue on its path to join the developed high-income group—so long as the central government recognizes and uses the policy space available to it.Download:Associated Program:Author(s): -

Fiscal Policy and Rebalancing in the Euro Area

Working Paper No. 776 | September 2013A Critique of the German Debt Brake from a Post-Keynesian Perspective

The German debt brake is often regarded as a great success story, and has therefore served as a role model for the Euro area and its fiscal compact. In this paper we fundamentally criticize the debt brake. We show that (1) it suffers from serious shortcomings, and its success is far from certain even from a mainstream point of view; (2) from a Post-Keynesian perspective, it completely neglects the requirements for fiscal policies of member-countries in a currency union and will prevent fiscal policy from contributing to the necessary rebalancing in the Euro area; and (3) alternative scenarios, which could avoid the deflationary pressures of the German debt brake on domestic demand and contribute to internally rebalancing the Euro area, are extremely unlikely, as they would have to rely on unrealistic shifts in the functional income distribution and/or investment and savings behavior in Germany.

-

Reorienting Fiscal Policy

Working Paper No. 772 | August 2013A Critical Assessment of Fiscal Fine-Tuning

The present paper offers a fundamental critique of fiscal policy as it is understood in theory and exercised in practice. Two specific demand-side stabilization methods are examined here: conventional pump priming and the new designation of fiscal policy effectiveness found in the New Consensus literature. A theoretical critique of their respective transmission mechanisms reveals that they operate in a trickle-down fashion that not only fails to secure and maintain full employment but also contributes to the increasing postwar labor market precariousness and the erosion of income equality. The two conventional demand-side measures are then contrasted with the proposed alternative—a bottom-up approach to fiscal policy based on a reinterpretation of Keynes’s original policy prescriptions for full employment. The paper offers a theoretical, methodological, and policy rationale for government intervention that includes specific direct-employment and investment initiatives, which are inherently different from contemporary hydraulic fine-tuning measures. It outlines the contours of the modern bottom-up approach and concludes with some of its advantages over conventional stabilization methods.

Download:Associated Program:Author(s): -

Is the Link between Output and Jobs Broken?

Strategic Analysis, March 2013 | March 2013

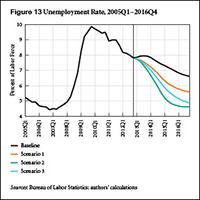

As this report goes to press, the official unemployment rate remains tragically elevated, compared even to rates at similar points in previous recoveries. The US economy seems once again to be in a “jobless recovery,” though the unemployment rate has been steadily declining for years. At the same time, fiscal austerity has arrived, with the implementation of the sequester cuts, following tax increases and the ending of emergency extended unemployment benefits just two months ago.

Our new report provides medium-term projections of employment and economic growth under four different scenarios. The baseline scenario starts by assuming the same growth rates and government deficits as the Congressional Budget Office’s (CBO) baseline projection from earlier this year. The result is a new surge of the unemployment rate to nearly 8 percent in the third quarter of this year, followed by a very gradual new recovery. Scenarios 1 and 2 seek to reach unemployment-rate goals of 6.5 percent and 5.5 percent, respectively, by the end of next year, using new fiscal stimulus.

We find in these simulations that reaching the goals requires large amounts of fiscal stimulus, compared to the CBO baseline. For example, in order to reach 5.5 percent unemployment in 2014, scenario 2 assumes 11 percent growth in inflation-adjusted government spending and transfers, along with lower taxes.

As an alternative, scenario 3 adds an extra increase to growth abroad and to private borrowing, along with the same amount of fiscal stimulus as in scenario 1. In this last scenario of the report, the unemployment rate finally pierces the 5.5 percent threshold from the previous scenario in the third quarter of 2015. We conclude with some thoughts about how such an increase in demand from all three sectors—government, private, and external—might be realistically obtained.

Download:Associated Program:Author(s): -

Marriner S. Eccles and the 1951 Treasury – Federal Reserve Accord

Working Paper No. 747 | January 2013Lessons for Central Bank Independence

The 1951 Treasury – Federal Reserve Accord is an important milestone in central bank history. It led to a lasting separation between monetary policy and the Treasury’s debt-management powers, and established an independent central bank focused on price stability and macroeconomic stability. This paper revisits the history of the Accord and elaborates on the role played by Marriner Eccles in the events that led up to its signing. As chairman of the Fed Board of Governors since 1934, Eccles was also instrumental in drafting key banking legislation that enabled the Federal Reserve System to take on a more independent role after the Accord. The global financial crisis has generated renewed interest in the Accord and its lessons for central bank independence. The paper shows that Eccles’s support for the Accord—and central bank independence—was clearly linked to the strong inflationary pressures in the US economy at the time, but that he was as supportive of deficit financing in the 1930s. This broader interpretation of the Accord holds the key to a more balanced view of Eccles’s role at the Federal Reserve, where his contributions from the mid-1930s up to the Accord are seen as equally important. For this reason, the Accord should not be seen as the eternal beacon for central bank independence but rather as an enlightened vision for a more symmetric policy role for central banks, with equal weight on fighting inflation and preventing depressions.

Download:Associated Program:Author(s): -

ECB Worries / European Woes

Working Paper No. 742 | December 2012The Economic Consequences of Parochial Policy

Financial market crises with the threat of a subsequent debt-deflation depression have occurred with increasing regularity in the United States from 1980 through the present. Almost reflexively, when confronted with such circumstances, US institutions and the policymakers that run them have responded in a fashion that has consistently thwarted debt-deflation-depression dynamics. It is true that these “remedies,” as they succeeded, increasingly contributed to a moral hazard in US and global financial markets that culminated with the crisis that began in 2007. Nonetheless, the straightforward steps taken by established institutions enabled the United States to derail depression dynamics, while European 1930s-style austerity proved as ineffective as it was almost a century ago. Europe’s, and specifically Germany’s, steadfast refusal to embrace the US recipe has fostered mushrooming economic hardship on the continent. The situation is gruesome, and any serious student of economic history had to have known, given European policy commitments, that it was destined to turn out this way.

It is easy to understand why misguided policies drove initial European responses. Economic theory has frowned on Keynes. Economic successes, especially in Germany, offered up the wrong lessons, and enduring angst about inflation was a major distraction. At the outset, the wrong medicine for the wrong disease was to be expected.

What is much harder to fathom is why such a poisonous elixir continues to be proffered amid widespread evidence that the patient is dying. Deconstructing cognitive dissonance in other spheres provides an explanation. Not surprisingly, knowing what one wants to happen at home completely informs one’s claims concerning what will be good for one’s neighbors. In such a construct, the last best hope for Europe is ECB President Mario Draghi. He seems to be able to speak German and yet act European.

Download:Associated Program:Author(s):Robert J. Barbera Gerald Holtham -

A Meme for Money

Working Paper No. 736 | November 2012This paper argues that the usual framing of discussions of money, monetary policy, and fiscal policy plays into the hands of conservatives.That framing is also largely consistent with the conventional view of the economy and of society more generally. To put it the way that economists usually do, money “lubricates” the market mechanism—a good thing, because the conventional view of the market itself is overwhelmingly positive. Acknowledging the work of George Lakoff, this paper takes the position that we need an alternative meme, one that provides a frame that is consistent with a progressive social view if we are to be more successful in policy debates. In most cases, the progressives adopt the conservative framing and so have no chance. The paper advances an alternative framing for money and shows how it can be used to reshape discussion. The paper shows that the Modern Money Theory approach is particularly useful as a starting point for framing that emphasizes use of the monetary system as a tool to accomplish the public purpose.

It is not so much the accuracy of the conventional view of money that we need to question, but rather the framing. We need a new meme for money, one that would emphasize the social, not the individual. It would focus on the positive role played by the state, not only in the creation and evolution of money, but also in ensuring social control over money. It would explain how money helps to promote a positive relation between citizens and the state, simultaneously promoting shared values such as liberty, democracy, and responsibility. It would explain why social control over money can promote nurturing activities over the destructive impulses of our “undertakers” (Smith’s evocative term for capitalists).

Download:Associated Program:Author(s): -

Fiscal Policy, Unemployment Insurance, and Financial Crises in a Model of Growth and Distribution

Working Paper No. 723 | May 2012Recently, some have wondered whether a fiscal stimulus plan could reduce the government’s budget deficit. Many also worry that fiscal austerity plans will only bring higher deficits. Issues of this kind involve endogenous changes in tax revenues that occur when output, real wages, and other variables are affected by changes in policy. Few would disagree that various paradoxes of austerity or stimulus might be relevant, but such issues can be clarified a great deal with the help of a complete heterodox model.

In light of recent world events, this paper seeks to improve our understanding of the dynamics of fiscal policy and financial crises within the context of two-dimensional (2D) and five-dimensional heterodox models. The nonlinear version of the 2D model incorporates curvilinear functions for investment and consumption out of unearned income. To bring in fiscal policy, I make use of a rule with either (1) dual targets of capacity utilization and public production, or (2) a balanced-budget target. Next, I add discrete jumps and policy-regime switches to the model in order to tell a story of a financial crisis followed by a move to fiscal austerity. Then, I return to the earlier model and add three more variables and equations: (1) I model the size of the private- and public-sector labor forces using a constant growth rate and account for their social reproduction by introducing an unemployment-insurance scheme; and (2) I make the markup endogenous, allowing its rate of change to depend, in a possibly nonlinear way, on capacity utilization, the real wage relative to a fixed norm, the employment rate, profitability, and the business sector’s desired capital-stock growth rate. In the conclusion, I comment on the implications of my results for various policy issues.

-

Reorienting Fiscal Policy after the Great Recession

Working Paper No. 719 | May 2012The paper evaluates the fiscal policy initiatives during the Great Recession in the United States. It argues that, although the nonconventional fiscal policies targeted at the financial sector dwarfed the conventional countercyclical stabilization efforts directed toward the real sector, the relatively disappointing impact on employment was a result of misdirected funding priorities combined with an exclusive and ill-advised focus on the output gap rather than on the employment gap. The paper argues further that conventional pump-priming policies are incapable of closing this employment gap. In order to tackle the formidable labor market challenges observed in the United States over the last few decades, policy could benefit from a fundamental reorientation away from trickle-down Keynesianism and toward what is termed here a “bottom-up approach” to fiscal policy. This approach also reconsiders the nature of countercyclical government stabilizers.

Download:Associated Program:Author(s): -

Full Employment through Social Entrepreneurship

Policy Note 2012/2 | March 2012The Nonprofit Model for Implementing a Job Guarantee

The conventional approach of fiscal policy is to create jobs by boosting private investment and growth. This approach is backward, says Research Associate Pavlina R. Tcherneva. Policy must begin by fixing the unemployment situation because growth is a byproduct of strong employment—not the other way around. Tcherneva proposes a bottom-up approach based on community programs that can be implemented at all phases of the business cycle; that is, a grass-roots job-guarantee program run by the nonprofit sector (with participation by the social entrepreneurial sector) but financed by the government. A job-guarantee program would lead to full employment over the long run and address an outstanding fault of modern market economies.

Download:Associated Program:Author(s): -

The European Central Bank and Why Things Are the Way They Are

Working Paper No. 710 | March 2012A Historic Monetary Policy Pivot Point and Moment of (Relative) Clarity

Not since the Great Depression have monetary policy matters and institutions weighed so heavily in commercial, financial, and political arenas. Apart from the eurozone crisis and global monetary policy issues, for nearly two years all else has counted for little more than noise on a relative risk basis.

In major developed economies, a hypermature secular decline in interest rates is pancaking against a hard, roughly zero lower-rate bound (i.e., barring imposition of rather extreme policies such as a tax on cash holdings, which could conceivably drive rates deeply negative). Relentlessly mounting aggregate debt loads are rendering monetary- and fiscal policy–impaired governments and segments of society insolvent and struggling to escape liquidity quicksands and stubbornly low or negative growth and employment trends.

At the center of the current crisis is the European Monetary Union (EMU)—a monetary union lacking fiscal and political integration. Such partial integration limits policy alternatives relative to either full federal integration of member-states or no integration at all. As we have witnessed since spring 2008, this operationally constrained middle ground progressively magnifies economic divergence and political and social discord across member-states.

Given the scale and scope of the eurozone crisis, policy and actions taken (or not taken) by the European Central Bank (ECB) meaningfully impact markets large and small, and ripple with force through every major monetary policy domain. History, for the moment, has rendered the ECB the world’s most important monetary policy pivot point.

Since November 2011, the ECB has taken on an arguably activist liquidity-provider role relative to private banks (and, in some important measure, indirectly to sovereigns) while maintaining its long-held post as rhetorical promoter of staunch fiscal discipline relative to sovereignty-encased “peripheral” states lacking full monetary and fiscal integration. In December 2011, the ECB made clear its intention to inject massive liquidity when faced with crises of scale in future. Already demonstratively disposed toward easing due to conditions on their respective domestic fronts, other major central banks have mobilized since the third quarter of 2011. The collective global central banking policy posture has thus become more homogenized, synchronized, and directionally clear than at any time since early 2009.