Latest Publications

-

Working Paper No. 1108March 05, 2026

Monetary Policy Transmission to Consumption: Inequalities by Gender and Race

-

Policy Note No. 2026/1February 24, 2026

The US Supreme Court Rules and Future Prospects of Trump’s Tariff Gambit

-

Working Paper No. 1107February 20, 2026

Artificial Intelligence: Friend, Foe, Fraud

-

Working Paper No. 1106February 19, 2026

Monetary Policy, Deposit Funding Shocks, and Bank Credit Supply: Bank-Level IV Evidence

-

Working Paper No. 1105January 22, 2026

OPENSIMPLEST: The Smallest SFC Open Economy Model

News & Events

Event May 08, 2026

Where: Levy Economic Institute of Bard College

Levy Economics Institute Anniversary Conference

Event starts 08 May 2026Where: Levy Economic Institute of Bard College

News

February 06, 2026

“The labor market is a very challenging place for young workers,” Tcherneva for Marketplace

News

December 18, 2025

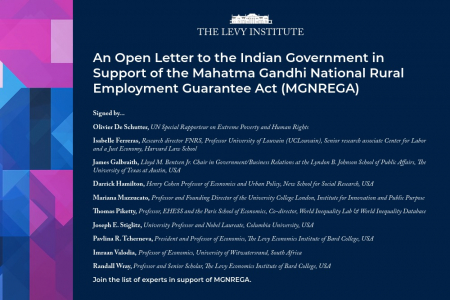

An Open Letter to the Indian Government in Support of the Mahatma Gandhi National Rural Employment...

News

December 18, 2025

Featured Commentary

The US Supreme Court Rules and Future Prospects of Trump’s Tariff Gambit

Yan LiangCost Estimate for New York Student Voter Empowerment Act

Jonathan Becker, Jordan Ayala, and Renata KarpenkoThe “Dark Horse” and the Bright Line: Why a Fundamental Fed Reform Is Overdue

Pavlina R. Tcherneva and L. Randall WrayLevy Institute Capitol Hill Series: Rethinking the Federal Reserve’s Policy Framework and Independence